Automated Credit Risk Assessment: How ETL Is Unlocking Better Investments

What if you could automate your credit risk assessment workflows and make them faster, easier, and more accurate? What if you could save up to 91% on coding and data preparation time, 80% on data pipeline building time, and 65% on tool costs?

Automated credit risk assessment workflows allow you to do just that. Let’s explore how!

End-to-End Credit Risk Assessment Process

The credit risk assessment is a lengthy process where banks receives hundreds of loan applications daily from various channels, such as online forms, email, phone, and walk-in customers. You must evaluate the creditworthiness of each applicant and decide whether to approve or reject the loan request.

To assess credit risk accurately, you must collect and analyze data from multiple sources, such as its internal databases, external credit bureaus, and third-party data providers.

However, collecting this data can lead to several several challenges, such as:

- The data is in different formats, such as CSV, JSON, XML, etc.

- The data is stored in different locations, such as local files, cloud storage, databases, etc.

- The data is updated at different frequencies, such as daily, weekly, monthly, etc.

- The data quality is inconsistent, such as missing values, errors, duplicates, etc.

- Data transformation and analysis require complex coding and scripting skills, such as SQL, Python, and R.

- The data pipeline is prone to errors and failures, such as network issues, server downtime, data corruption, etc.

How Astera Helps Simplify Credit Assessment

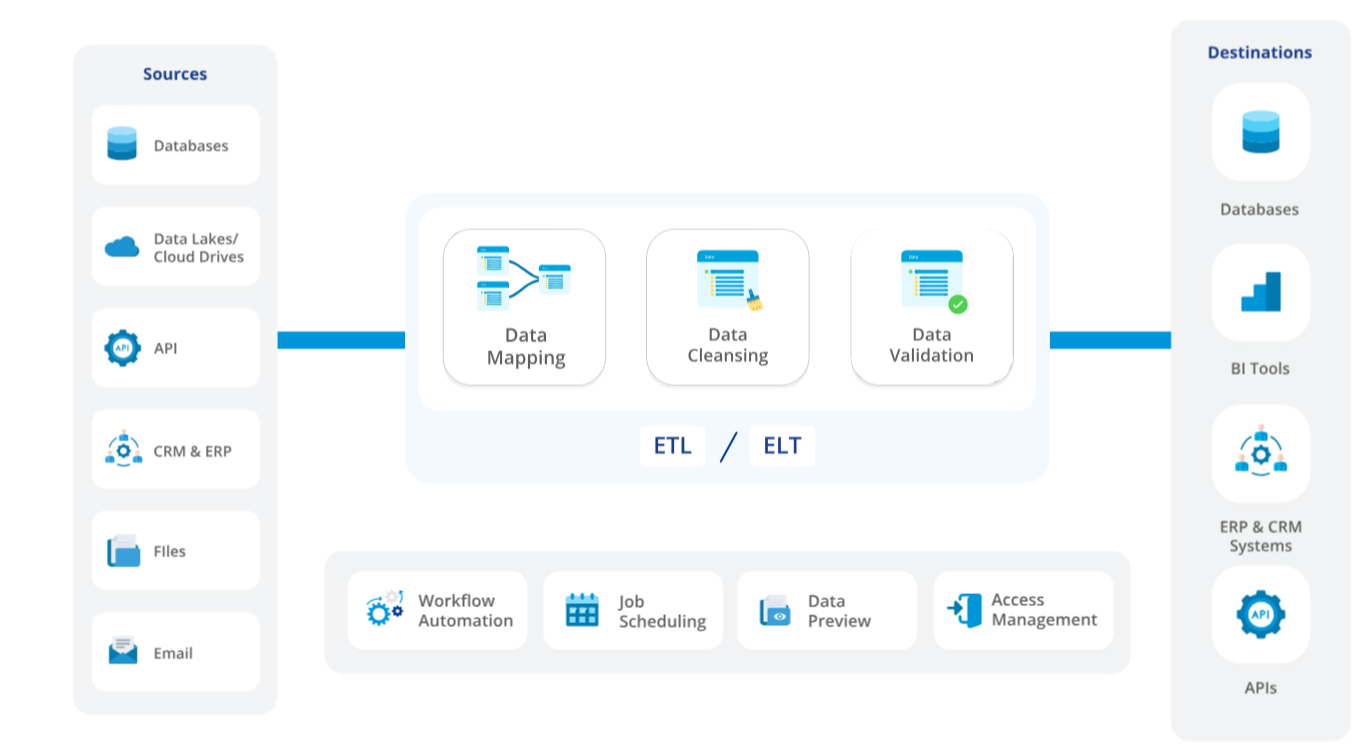

Data Extraction

Some of the native connectors in Astera

Banks use internal databases (like customer relationship and loan management systems) and external data providers (like credit bureaus) as the data sources.

Astera offers Data Connectors to set up secure connections to these data sources and ensure they have the necessary data access permissions. Astera has built-in connectors for various data sources, such as databases, files, web services, etc.

You can leverage these connectors to select the data sources and select the fields they want to extract, such as customer demographics, credit history, transaction details, and loan details.

Astera allows you to preview the data and apply filters and joins as needed using drag-and-drop operations without writing SQL queries or Python scripts. The data is retrieved and stored in a temporary location for further processing. Astera handles the data extraction process in the background and notifies the users when the data is ready.

Data Transformation

Astera also offers Data Quality and Data Transformation features to inspect, clean, and transform the data. You can leverage a graphical interface to drag and drop various operations on the data without writing any code.

You can clean the data by removing duplicates, filling in missing values, correcting errors, and standardizing entries. For instance, Astera’s Address Verification feature can help you standardize all addresses to a standard format.

You can also transform the data by converting data types, encoding categorical variables like gender or loan type, normalizing numerical variables like income, and creating new features like debt-to-income ratio. For instance, you can also use Astera’s Expression Builder to create custom calculations and expressions on the data.

Likewise, once your team has cleansed data for credit risk assessment, you can validate the transformed data by checking it against predefined rules and sample outputs.

Here are some data validation rules that can make credit risk assessment more reliable:

- Probability of Default (PD): This is a key parameter in credit risk models. It measures the likelihood that a borrower will default on a loan. The validation of this parameter involves checking the discriminatory power of PD models.

- Loss Given Default (LGD): This measures the potential loss to the lender or investor in the event of default by a borrower. The validation process should include a review of the discriminatory power of LGD models.

- Expected Loss Best Estimate (ELBE): This is an estimate of the expected loss on an exposure. The validation process should ensure that the ELBE is calculated accurately.

- Credit Conversion Factor (CCF): This is used in the calculation of potential future exposure. The validation process should check the accuracy of the CCF.

- Data Quality: Credit institutions should have internally established quality and reliability standards on data (historical, current, and forward-looking information) used as model inputs.

- Model Design and Outputs: The validation should include a review of model design and model outputs/performance.

Data Loading

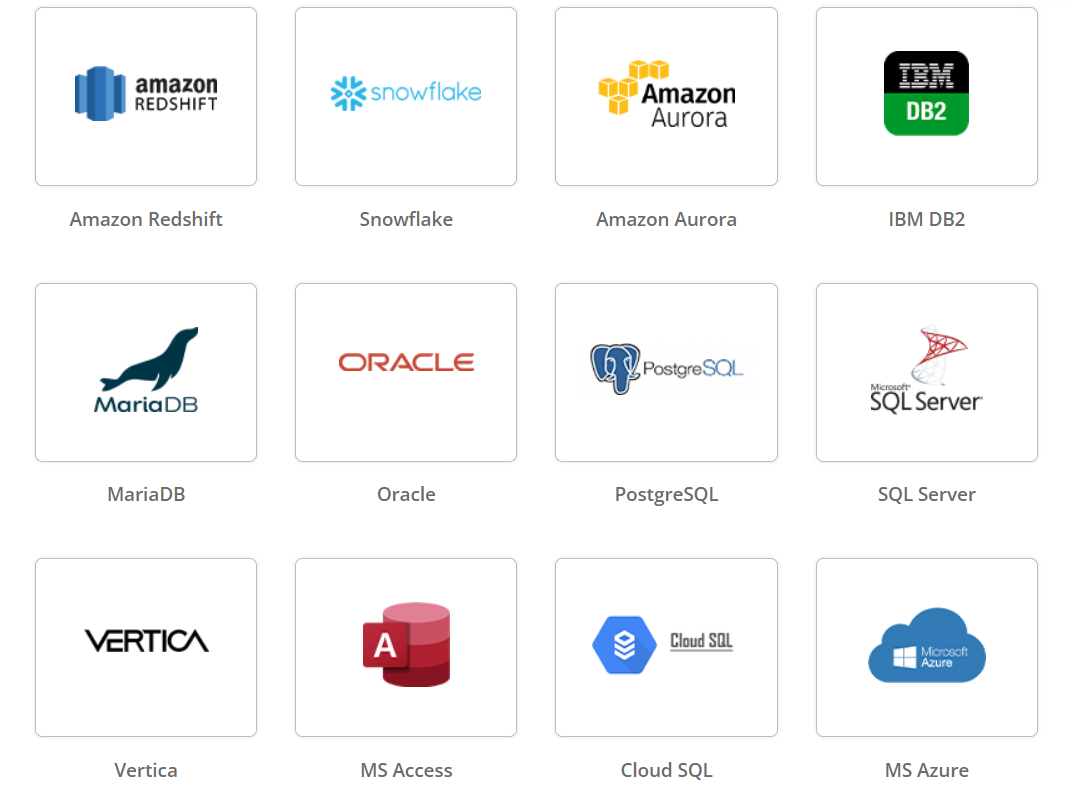

Once you’ve have ensured data quality, you must configure a secure connection to the bank’s data warehouse using Astera’s Data Connectors. Astera has native connectors for various data warehouses, such as Amazon Redshift, Google BigQuery, or Snowflake, and can also load data into other destinations, such as files, databases, etc.

Astera’s Data Destinations can be critical in setting up the credit risk assessment pipelines. You must select the data warehouse and specify the destination table to store the cleaned and transformed data. Astera allows them to set the table name, schema, and keys with a few clicks without writing SQL commands. Astera also provides options to append, replace, or update the existing data with simple configurations.

Once you decide on how to model your data, you can configure data loading using Astera’s Data Flows. Astera enables you to create and execute data flows that connect the data sources and destinations and apply the transformations and validations along the way. Astera also supports Change Data Capture and Slowly Changing Dimensions to load incremental and historical data.

You can validate the loaded data by running sample queries and checking the results using Astera’s Data Preview. Astera allows them to view and query the data in the data warehouse and compare it with the source data.

Data Aggregation

Your team can define aggregation rules using Astera’s Aggregate transformation to group/aggregate the data by customer and month.

You can group the data according to these rules. Lastly, you can validate the aggregated data by checking it against predefined rules and sample outputs using Astera’s Data Quality and Data Preview features.

Astera allows you to define and apply data quality rules and validations on the aggregated data and view and query the data in the data warehouse or any other data source or destination.

Risk Analysis

Credit risk assessment experts can define risk indicators using Astera’s data transformations. For instance, they can leverage Astera’s Expression Builder to create custom calculations and expressions on the data, such as debt-to-income ratio. You can also leverage Astera’s Data Quality Rules to define and apply business rules and validations on the data, such as high credit risk.

Automation

Once deployed, your team can automate the credit risk assessment flows using Astera’s Automation and Orchestration features. Astera allows you to create and execute workflows that automate the data extraction, transformation, loading, aggregation, and analysis processes and orchestrate them with other tasks, such as sending emails, calling web services, running commands, etc.

You can also test the automation in a controlled environment using Astera’s Test Mode and Debug Mode features. Astera allows you to run the workflows in a test mode that simulates the data flow without affecting the actual data and debug the workflows in a debug mode that shows the data flow step by step and identifies any errors or issues.

You can deploy the automation in the production environment using Astera’s Deployment and Scheduling features. Astera allows you to deploy the workflows to a server deployed on-premises or on the cloud and schedule them to run at regular intervals, such as every night at midnight, or trigger them on demand or by an event, such as a file drop or a web request.

Monitoring and Updating

Astera allows you to monitor your data warehouse and alert your team if the system fails or produces unexpected results. You can configure these mechanisms in Astera’s workflow canvas, notifying your team of of errors or failures by email or web service.

You can regularly check the system to ensure it is working as expected and to identify any issues as soon as they arise by analyzing your workflow logs. Astera maintains a log of the workflow execution history and the data lineage and an audit trail of the workflow changes and the user actions.

With these insights, your team can continually improve the system based on feedback from the data and risk management teams and new data using Astera’s Version Control and Metadata Management features.

Astera supports version control of the workflows, data sources and destinations, and metadata management of the data schemas and mappings.

The Impact of Astera on Automating Credit Risk Assessment

Save Time and Costs

One of the benefits of using Astera to automate credit risk assessment workflows is that it can save time and costs for Banks. By automating the credit processes and digitizing the critical steps in the credit value chain, Astera can help Banks reduce the manual effort and complexity involved in data integration and processing.

Likewise, Astera enables users to design, execute, and manage data integration workflows without writing any code, using a graphical interface, and using drag-and-drop operations. Astera also automates the data extraction, transformation, loading, aggregation, and analysis processes and orchestrates them with other tasks, such as sending emails, calling web services, running commands, etc.

This means that users can save time and effort and focus on the business logic and outcomes rather than the technical details and complexities. Astera also makes it easy to collaborate and share workflows with other users and maintain and update workflows as the data and business requirements change.

According to McKinsey, this can yield up to 50 percent cost savings for Banks. The article also states that digitization can reduce credit losses by 10 to 20 percent by improving the accuracy and speed of credit decisions.

Similarly, a survey by S&P Global found that 71% of banks indicated that digitization provides better risk control and management to protect organizational profitability. Therefore, automating and digitizing the credit risk assessment workflows could help Banks save time and costs.

Improve Data Quality and Accuracy

One of the benefits of using Astera to automate credit risk assessment workflows is that it can improve data quality and accuracy for banks. These two metrics are crucial for making sound credit decisions, managing risk exposures, complying with regulations, and controlling pricing.

Using Astera’s data quality features, finance firms can eliminate errors and inconsistencies and ensure the data is accurate, consistent, and reliable. Astera provides a range of data quality and data transformation functions, such as cleansing, validating, enriching, converting, encoding, normalizing, and creating custom transformations.

Astera also provides real-time data health features, such as data profiling, data quality dashboard, and data quality rules, that allow users to inspect, monitor, and resolve data quality issues, such as missing, inconsistent, duplicate, or invalid values. Astera also supports data lineage and metadata management, allowing users to track and document data sources, destinations, schemas, mappings, and transformations.

Lastly, Moody’s Analytics discovered that integrating risk data elements improves the origination workflow by providing higher accuracy in decisions, better assessment of total risk exposures, improved compliance, and greater control over pricing. Astera allows users to tap into multiple diverse data sources, which are typically difficult to access.

Scale Data Operations and Performance

Astera’s cloud-based and distributed computing capabilities can help scale data operations and performance.

Cloud-based data sources such as Amazon S3, Google Cloud Storage, Azure Blob Storage, etc., allow users to store and access large volumes of data in the cloud and benefit from the cloud services’ scalability, availability, and cost-effectiveness. According to Accenture, cloud-based data integration solutions can reduce the total cost of ownership by 30% to 40%.

Likewise, Astera supports cloud-based data warehouses, such as Amazon Redshift, Google BigQuery, or Snowflake.

Lastly, parallel processing, load balancing, and fault tolerance helps users process large volumes of data faster and more reliably. As a result, they can benefit from the distributed systems’ efficiency, scalability, and resilience.

Increase Data Security and Compliance

Another benefit of using Astera is increased data security and compliance. Using Astera’s robust features, banks can encrypt the data in transit and at rest and adhere to industry standards and regulations. Astera provides data encryption features, such as SSL/TLS, AES, and PGP, that allow users to encrypt the data when it is transferred or stored and protect it from unauthorized access or tampering.

One study revealed that 40% of teams continually review compliance controls with automation, which can increase data security and compliance. Therefore, Astera can help Banks improve data security and compliance by using its data security and compliance features.

Save Millions in Investments by Simplifying Risk Assessment

Automate your Risk Assessment using Astera Centerprise – a simple no-code ETL tool with a drag-and-drop interface that helps you simplify your ETL process with significant time and money savings.

Book a FREE Demo Today!Transform Credit Risk Assessment with Astera

Astera Centerprise is a powerful and user-friendly ETL tool that can help finance organizations automate credit risk assessment. It allows you to integrate data from various sources and systems, such as databases, data warehouses, file formats, cloud-based data providers, file systems, and web services.

Astera Centerprise can help automate and orchestrate data flows and perform complex data transformations, validations, and mappings, providing your team with timely insights into credit risk assessment. With Astera, your team has a holistic view of each applicants data, giving them all the instruments they need to assess their credit worthiness effectively.

If you want to experience the power of Astera for yourself, sign up for a free 14-day trial or schedule a custom demo with our experts.

NEW RELEASE ALERT

NEW RELEASE ALERT

March 27th, 2025

March 27th, 2025