Accounts Payable Automation: A Comprehensive Guide

What is Accounts Payable Automation/AP Automation?

Accounts payable automation—also known as AP automation—is a modern approach to handling accounts payable workflows. It combines multiple tools and technologies, enabling businesses to digitalize and streamline their AP management processes from beginning to end.

AP automation automates various repetitive tasks, such as invoice receipt, reconciliation, and reporting. To do so, it uses a combination of artificial intelligence (AI)-powered tools such as intelligent document processing (IDP), robotic process automation (RPA), and workflow orchestration.

Automate. Optimize. Thrive.

Free yourself from manual AP bottlenecks and focus on what matters. With Astera, you’ll achieve faster approvals, real-time insights, and airtight accuracy. Step into the future of accounts payable automation!

Contact UsWhy Automate Your Accounts Payable?

With automated accounts payable processes, businesses don’t need to worry about the following challenges:

- Time-Consuming Manual Processes: Physically inspecting paper invoices and entering relevant details into internal systems takes a lot of time. The time wasted ultimately affects payment timelines, potentially resulting in the company incurring late fees or penalties or missing out on early payment discounts.

- Paper Problems: Besides being time-intensive, handling paper invoices is a hassle. Invoices can quickly pile up when slow, manual invoice processing is the norm. The result? Piles of invoices and bills that are difficult to manage, track, and store.

- Human Errors: Manual procedures create unnecessary room for human mistakes. These mistakes can range from miscalculations and typos to forgetting to input an invoice or inputting it more than once. Fixing these mistakes adds to the accounting workload and requires additional time—and that’s if they’re caught.

- Reconciliation Difficulties: Old-school AP procedures result in obscure, hard-to-follow invoice management. Paper invoices lack traceability and can easily go missing in the cycle of manual approvals. This diminished transparency makes it challenging to reconcile payments or audit accounts.

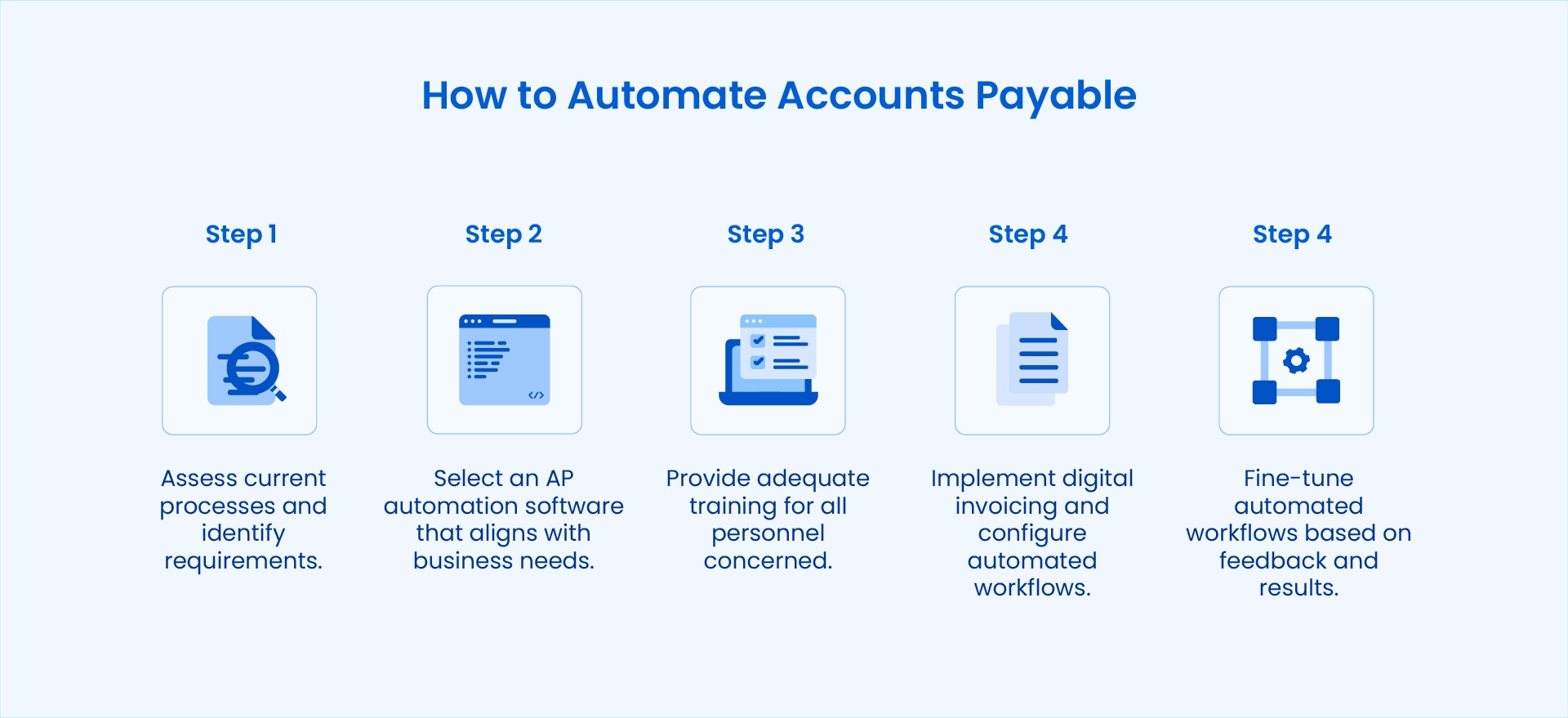

How to Automate Accounts Payable

How AP Automation Works

These are the key components of accounts payable automation:

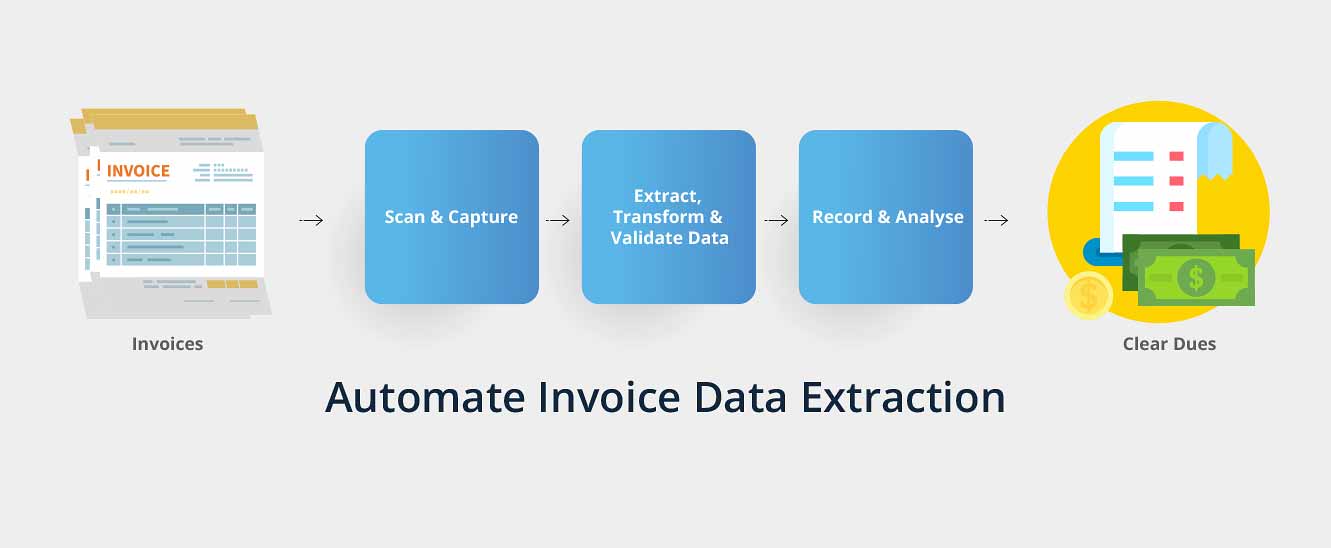

1. Invoice Capture

In the initial phase, accounts payable automation software extracts relevant information from digital invoices and converts it into structured data. These invoices can be in the form of scanned documents, PDFs, or other formats. Early automation tools primarily used optical character recognition (OCR). Newer platforms use IDP, which combines OCR with machine learning (ML) algorithms, natural language processing (NLP), and AI.

2. Data Verification and Matching

After capturing and converting the invoice data, the AP automation solution validates it against corresponding receipts, purchase orders, and contracts. This ensures consistency between the invoices and the purchase terms. At this stage, pre-defined rules (set up by the business) can quickly catch any discrepancies and flag them for review. This leaves only error-free invoices for further processing.

3. Automated Approvals

Next, the validated invoices are automatically delivered to the relevant party for approval. Pre-defined conditions are essential to keeping things moving smoothly at this stage. Businesses can choose to sort invoices by amounts, vendors, or other unique criteria to ensure that there are no conflicts or overlaps. Optionally, reminders and alerts can help further expedite the approval process. This automated approach ensures that all invoices are delivered to the correct department or personnel, decreases the risk of missed invoices, and records all approval activity.

4. Invoice Payments

Once an invoice is approved, an AP automation system can streamline the payment process through integration with ERP systems, bank portals, or accounting systems. It can further facilitate businesses by executing payments on a schedule, selecting a payment method, or processing a payment automatically. Automated payments enable enterprises to settle their dues on time, increase their reliability and trustworthiness, and build better relationships with their vendors.

5. Reporting and Reconciliation

When the payments are complete, automated reconciliation matches them with bank statements to confirm payment amounts and beneficiaries, bypassing the need for manual verification.

AP automation platforms can also create detailed reports focusing on metrics such as average invoice processing time, discounts offered vs. captured, and the percentage of late-paid invoices. These insights into AP metrics help businesses identify room for savings and cash flow optimization.

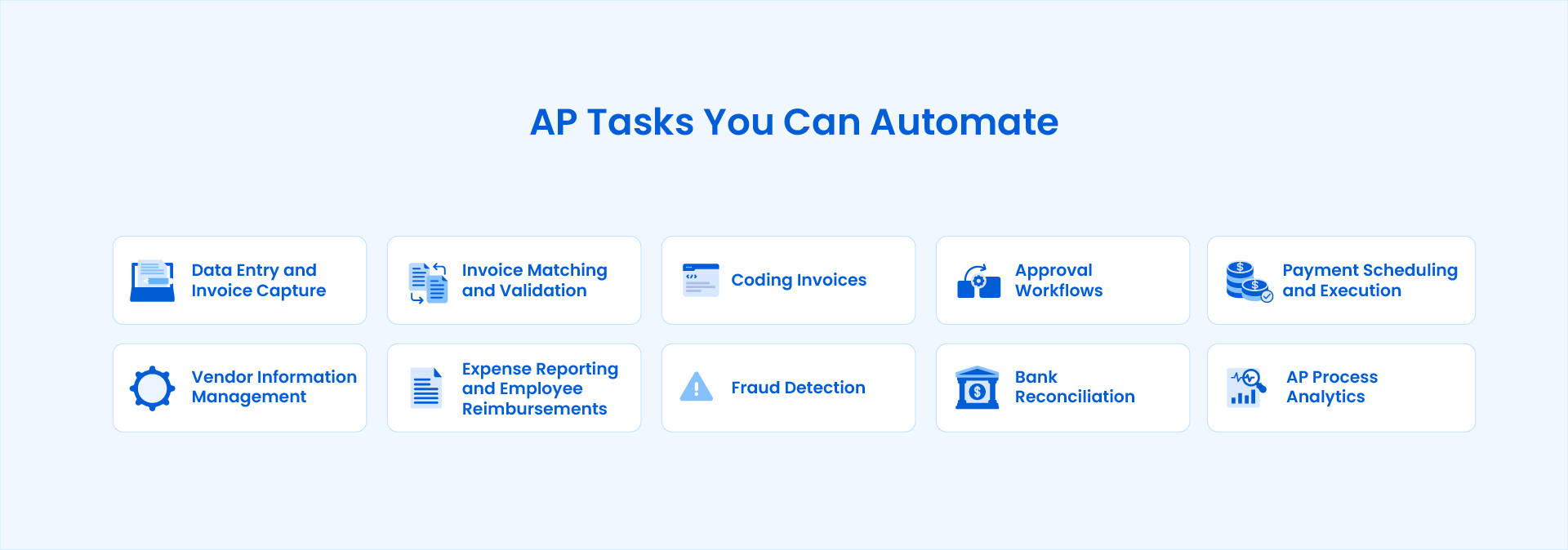

Which AP Tasks Benefit from Automation?

Automation is beneficial whenever businesses want to decrease the manual effort or time required to complete a task. Here’s a list of AP tasks that can be easily automated:

- Data Entry and Invoice Capture

Automation tools enable the extraction of information from invoices and other documents, reducing manual entry errors and accelerating the data entry process.

- Invoice Matching and Validation

Automated systems streamline the process of matching invoices to purchase orders and receipts, ensuring that discrepancies are identified and resolved before further processing.

- Coding Invoices

Invoice coding can be automated using predefined rules, allowing the correct general ledger codes to be assigned without manual intervention.

- Approval Workflows

Digital workflows ensure that invoices are routed to the appropriate approvers according to organizational policies, accelerating approval timelines and providing an audit trail.

- Payment Scheduling and Execution

Automated scheduling ensures payments are processed on time, leveraging early payment discounts and avoiding late penalties.

- Vendor Information Management

Automation systems maintain up-to-date vendor records, including contact details, payment terms, and compliance documentation, supporting efficient vendor interactions.

- Expense Reporting and Employee Reimbursements

Automated platforms simplify the processing of expense reports by categorizing claims, verifying receipts, and routing requests for approval.

- Fraud Detection

Intelligent algorithms monitor transaction data to detect unusual patterns and flag potential fraud, enhancing security across accounts payable operations. A clear use case of RPA in finance is to enhance security and reduce risk.

- Bank Reconciliation

Automated reconciliation tools compare recorded transactions with bank statements, quickly identifying mismatches and ensuring accurate financial records.

- AP Process Analytics

Automation platforms provide insights into accounts payable processes through data visualization, highlighting trends, bottlenecks, and areas for optimization.

AP Automation Benefits

Automated accounts payable lead to both financial and non-financial benefits for a business. Here are some of the major ones:

- Increased Time Savings: AP automation takes repetitive manual tasks, such as data entry and invoice matching, out of the equation. Automated data capture and processing decreases processing times significantly, especially compared to manual methods. This faster pace has a compound effect and accelerates the entire AP cycle.

- Cost and Labor Benefits: AP automation drastically reduces human involvement, manual intervention, and error rectification. There are no physical invoices to store and no associated overheads. Businesses save on labor costs since there’s no need for big teams to manage invoices and payments. Personnel can instead perform higher-value tasks that require human intelligence and judgment.

- Better Compliance and Security: Automated AP tools can track every action performed on an invoice throughout the AP cycle and create a digital audit trail that helps with compliance. These documented activities make it easier for businesses to meet regulatory requirements and pass audits. Automation solutions are also equipped with security features such as role-based access control and encryption. These features decrease the risk of unauthorized access and protect financial data.

- Clearer Financial Visibility: AP automation systems track invoices and payments in real-time or near-real-time. This capability provides finance teams with a clear view of the company’s financial obligations and transactions. They can plan payments strategically to better utilize their working capital and cash reserves.

- Sustainability and Environmental Impact: Modern businesses are under increasing pressure to prioritize sustainability in their operations and be mindful of their environmental impact. AP automation contributes to a company’s sustainability efforts by eliminating paper invoices. A digitalized AP process helps businesses decrease their waste generation and reduce their carbon footprint.

- Greater Financial Accuracy: AP automation adds to financial accuracy in two ways. Firstly, by minimizing the possibility of human errors while processing accounts payable. Secondly, through built-in validation measures that lower the risk of fraudulent or duplicate payments. High-quality financial data improves decision-making through reliable insights and helps in proper financial management.

A Faster Way of Processing Your Accounts Payable

Ready to eliminate errors, reduce costs, and save time? Astera’s powerful AI-driven platform enables you to take control of your workflows with intelligent automation. Set up a demo and discover its capabilities!

Let's Get StartedAccounts Payable Automation with Astera

Businesses that automate their accounts payable gain a lot more than a faster and more reliable solution. Implementing an AP automation platform saves resources, minimizes errors, improves vendor relationships, and optimizes cash flow management.

Astera offers an AI-powered, all-in-one data management platform with remarkable IDP capabilities that can transform accounts payable management. Users can create automated extraction workflows that:

- Collect relevant data from invoices, no matter the format.

- Use data quality and validation checks to maintain the integrity of invoice data.

- Export accurate invoice data to their ERP systems.

Moreover, Astera supports natural language queries, which means analyzing invoice data is as simple as asking a question in plain English, with no technical knowledge required!

Learn more about how Astera can support your accounts payable automation. Contact our team today!

Astera AI Agent Builder - First Look Coming Soon!

Astera AI Agent Builder - First Look Coming Soon!