The 10 AP Automation Benefits (+1 Bonus Benefit) For Enterprises

Accounts payable (AP) automation is on the rise as finance teams are realizing the benefits of AP automation solutions currently on the market. Teams that achieve partial automation in their AP processes are seeing considerable benefits in terms of time, cost, and efficiency.

With vendors now integrating AI technologies into their software solutions, the potential AP automation benefits promise to change the face of accounts payable altogether.

What is Accounts Payable Automation?

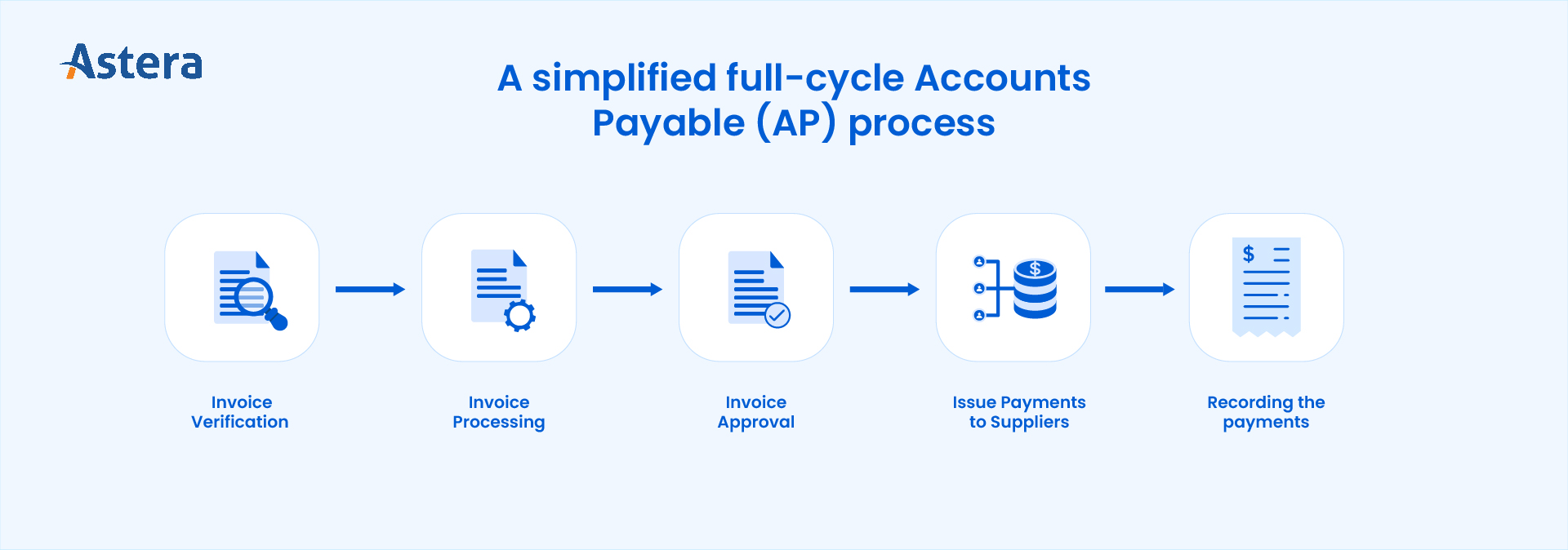

Accounts Payable (AP) automation refers to the use of different technologies, such as AI, to automate the processes involved in paying invoices by reducing most or all manual tasks. The goal is to manage the full cycle accounts payable process with minimal to no human oversight. In the simplest of terms, these are the steps involved in the AP process:

In other words, AP automation enables timely, accurate, efficient, and compliant processing of large volumes of financial transactions and invoices between an organization and its vendors or suppliers.

The Current State of Automation in Accounts Payable (AP)

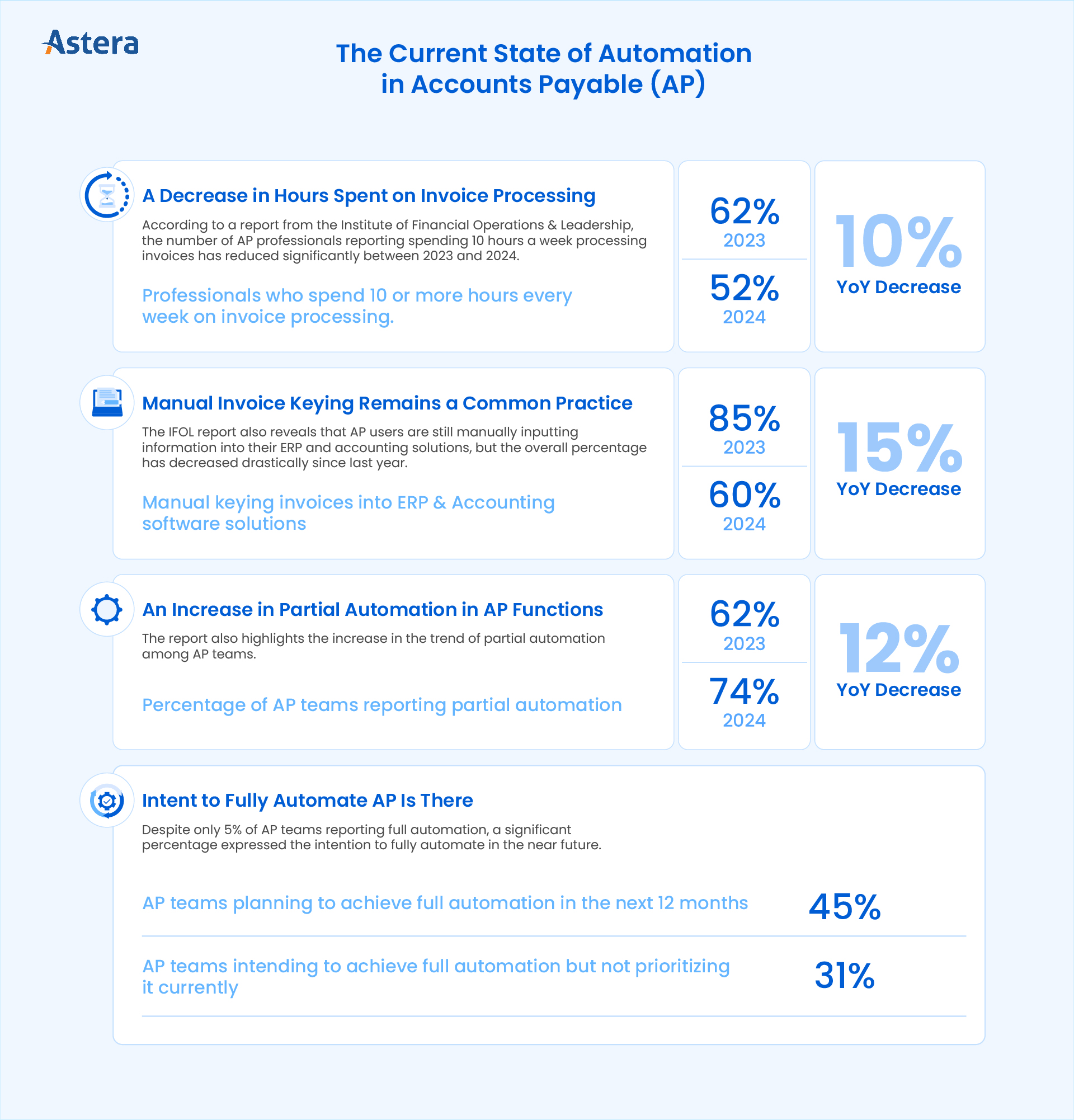

Automation has been slowly making its way into accounts payable with the years 2023 and 2024 proving fruitful for organizations that have implemented automation in small or large measures. Here’s a brief look at the current state of AP automation:

The 10 Benefits of AI-Powered AP Automation

AP automation solutions featuring AI technologies offer a host of benefits for enterprises and SMBs alike. In addition to the more obvious ones, such as increased accuracy and cost reductions, AP automation can also improve data-driven decision-making, supplier relationships, and cash flow visibility. Let’s look at all the benefits of AP automation:

1. Enhanced Accuracy

According to PYMNTS, 85% of CFOs believe AP automation leads to more accurate processes. Plus, 47.1% of AP professionals consider data errors and discrepancies causing process delays for approvers and stakeholders as one of the biggest AP challenges.

AP automation enhances accuracy by eliminating manual data entry, significantly reducing human error. This minimizes mistakes in keying invoice details, amounts, and supplier information. AI-powered Optical Character Recognition (OCR) captures invoice data accurately, ensuring records are consistent and correct.

2. Increased Efficiency

The top challenge teams face with their current accounts payable processes is the extensive manual data entry work. IFOL reports that 51.4% of AP professionals consider it as their biggest challenge. The same study also reports that 71% of AP professionals want to automate to speed up the payable process. However, according to PYMNTs, 85% of financial leaders agree that AP automation can improve the efficiency of current AP processes.

By automating their accounts payable, teams can streamline their processes, allowing invoices to be processed faster and reducing the time required for invoice approval and payment. This also frees up resources to focus on higher-value tasks.

3. Cost Savings

Cost savings remain one of the primary reasons for AP automation, especially for teams handling large volumes of invoices. With 80% of businesses anticipating growth in the volume of payments made through their AP systems in the coming years, AP automation can result in significant cost savings. For instance, reducing manual processes helps companies save on manual labor and avoid late payment penalties, considering that 80% of businesses regularly receive late payments.

4. Fraud Detection & Reduction

According to AFP, 65% of payment fraud in B2B transactions originates from paper checks. By eliminating paper checks through AP automation, businesses can significantly reduce the risk of fraudulent payments. Plus, AP automation solutions also include security features to flag unusual payment patterns or duplicate invoices.

5. Time Savings

According to the IFOL report, 50% of the finance teams spend more than 10 hours every week on processing invoices and issuing payments, while 30% spend 6-10 hours. Goldman Sachs estimates that AP automation can result in 70-80% time savings on average. This is because automation eliminates repetitive tasks, which also empowers AP teams to focus on more strategic activities. Plus, the higher accuracy also leads to fewer errors, which means even with partial automation, AP teams spend less time on proofing and reviewing invoices and payments.

6. Large Invoice Volumes & Scalability

The total volume of invoices processed by an AP team can depend on the nature and size of the business, but the increasing invoice volume is a pain point for finance teams. The need for AP automation becomes more evident, with PYMNTS reporting that 80% of companies are anticipating an increase in the volume of invoice payments. With AP automation, finance teams can ensure scalability without worrying about additional costs and resources.

7. Improved Vendor Relationships

According to the IFOL report, 41.4% of AP professionals report damage to vendor relationships due to the delays caused by manual invoice processing. Similarly, 38.6% report delays in delivery from suppliers and vendors. In other words, a vicious cycle of delays from and on both ends. With AP automation, AP teams can eliminate delays which in turn improves vendor relationships while also ensuring timely payments and subsequent timely delivery of goods or services.

8. Risk and Compliance

60% of finance leaders want to automate their AP function to increase controls and reduce risk, while 64% are expecting AI to mitigate risk and improve compliance in their AP processes. Automation of invoices improves tracking and reporting, which in turn simplifies compliance with financial regulations. Since automation streamlines the retrieval and storage of all invoices and payment records, businesses can improve preparedness for audits without the need for extensive manual record-keeping.

9. Increased Visibility & Cash Flow Optimization

37% of financial leaders want to automate AP to increase visibility across the invoice process, while 22.9% report that lack of visibility is their biggest AP challenge currently. AP automation delivers real-time visibility into outstanding payables, helping finance teams manage cash flow more effectively by automatically scheduling invoice payments based on their cash position.

Automated AP combined with real-time data analysis also helps organizations identify irregularities, trends, and opportunities across their AP function. With increased visibility into their cash flow, AP teams can also support proactive decision-making for optimized capital allocation strategies.

10. Automated Invoice Matching

Automation can also help AP teams automatically match invoices to receipts and purchase orders, ensuring greater transparency while also confirming that the company only pays for the goods or services it ordered and received. Commonly known as the three-way match, it’s a common accounting practice that is otherwise done manually or often not at all if the invoice volume is too high. By automating this process, AP teams can easily flag overspending and even identify fraudulent payments.

Bonus Benefit: Less Stressful AP

Manually processing invoices can be stressful considering the time-sensitive nature of the task as well as the potentially huge room for error. Automating accounts payable can also help financial leaders make invoice processing much less stressful for their employees. In fact, the IFOL study found that the biggest issue finance leaders face due to delays in manual AP processing was the stress on their team, with 64.3% citing it as the core issue they face.

A less stressful AP process not only improves employee well-being but also helps redirect resources toward more strategic initiatives and higher-order tasks.

Streamline your Accounts Payable (AP) through automation with Astera

Stay ahead of your competition by improving your bottom line with AP automation. With Astera's intuitive drag-and-drop UI and robust AI capabilities, you can automate your invoice processing and payments effortlessly.

Book a personalized demo to see how it works.Top 10 Industries/Sectors That Benefit from AP Automation the Most

AP automation benefits many sectors, but certain sectors, such as financial services, healthcare, technology, and logistics, stand to gain more than others due to reasons, such as unique operational challenges, high volume of transactions, or strict regulatory requirements. Let’s take a look at these sectors:

Make the Most of AP Automation with Astera

The benefits of AP automation are more than just ten, but organizations can only fully realize these benefits through full AP automation. Solutions automating one or two tasks in invoice processing are far and many, but very few can offer holistic, AI-powered AP automation that is tailored to your enterprise’s unique needs. That’s where Astera struts in.

Astera’s automated document processing solution is created to help enterprises make the most of their AP functions. With Astera, your AP team can achieve:

- 97% error reduction in accounts payable processes,

- 8 times faster invoice processing,

- 90% faster data extraction.

Seeing is believing. Schedule a demo with our team to see how Astera can transform your AP for the better; and for good.

Astera AI Agent Builder - First Look Coming Soon!

Astera AI Agent Builder - First Look Coming Soon!