Optimizing Auto Insurance Claims Processing with Astera

The car insurance industry today is addressing the challenge of managing vast amounts of unstructured data through innovative solutions. A leading insurer in the Asia-Pacific anticipates significant improvements through Generative AI over the next 12 months to enhance auto insurance claims processing efficiency and accuracy. Astera is a powerful tool that uses AI to make processing claims easier and more accurate.

With Astera, insurance companies can quickly sort through and analyze important information from various sources, speeding up the entire claims process.

Simplifying Claims Processing

Astera simplifies the complex process of data extraction, specifically unstructured data, in claims processing. With its code-free interface, Astera makes data extraction accessible to business users.

The core functionality of Astera relies on a template-based extraction model. Users can create Report Models or Extraction Templates that guide the software in identifying and extracting necessary data from various unstructured sources, such as scanned documents, fillable PDF forms, and text documents related to car insurance claims. This approach streamlines the data handling process through automation.

By leveraging Astera, businesses can transform unstructured claims data into a structured format. This is critical for speeding up the claims resolution process, improving accuracy, and ultimately enhancing customer satisfaction.

Key Features of Astera for Auto Insurance Claims Processing

Astera ReportMiner extracts information from complex claims documents, like PDFs of repair estimates or text documents carrying information about property damage. Businesses can use Astera ReportMiner to automate the tedious process of parsing various PDF documents, reducing the need for manual data entry operations.

AI-Powered Extraction

Astera ReportMiner uses AI to identify required fields within claim forms automatically, enhancing the extraction process. This AI-driven approach not only identifies but also intelligently evaluates the context and patterns in the data.

By automating data extraction from PDFs with AI, Astera ReportMiner eliminates the guesswork and manual effort traditionally involved in identifying and extracting key data points, streamlining the claims processing workflow.

Automated Workflows

Astera ReportMiner offers comprehensive automated workflow capabilities that cover the entire claims processing workflow from data extraction to decision-making. This includes automating the extraction pipeline to run on batches of PDF files, thereby making all desired information available promptly and efficiently.

Efficient Template Based Extraction

For text-based PDFs, users can create an extraction template using specific patterns present in the document, guiding Astera ReportMiner to accurately retrieve information. In the case of scanned PDFs, ReportMiner’s OCR capabilities transform these documents into text-based formats for building extraction templates.

Additionally, for form-based PDFs common in business operations, ReportMiner simplifies the extraction of business data for further reporting and analysis.

Once data is extracted, it can be transformed and exported to various destinations, including Excel spreadsheets, databases, and CSV files, facilitating a seamless integration into an organization’s existing data ecosystem.

Step-by-step Guide to Streamling Claims Processing

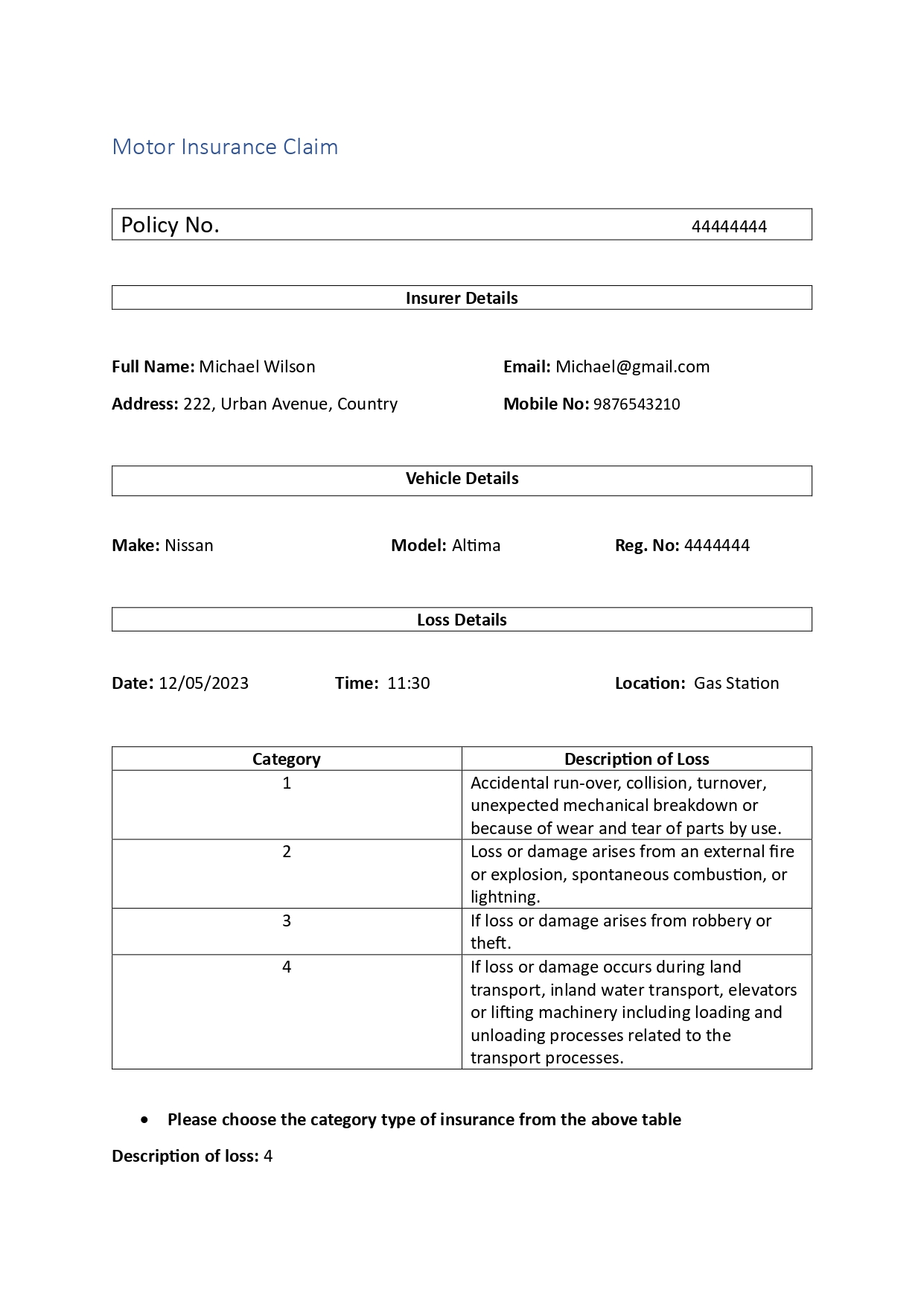

In this example, Astera streamlines the process from initial data extraction to claim resolution, taking a batch of car insurance claims as the use case. Each claim in this batch comes with detailed damage information n PDF format.

Step 1: To begin the process, load the PDF form into Astera ReportMiner’s designer.

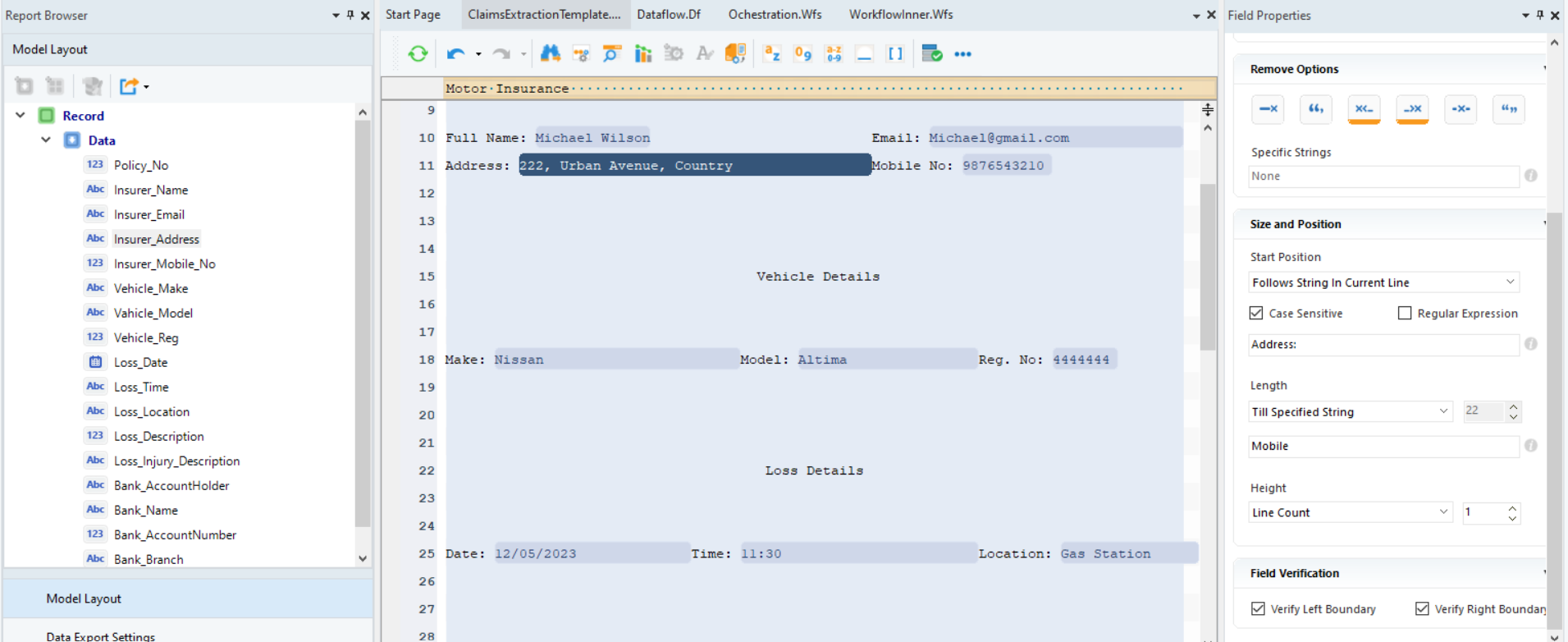

Step 2: Define extraction template by identifying and specifying the patterns that occur within the source report. These patterns will be identical for all files in our batch. which is why we will be able to use one extraction template on all files.

Step 3: In the field properties section, adjust the dimensions and positioning of data fields. For example, in the case of the Address Field, we defined it to follow string Address in the current line.

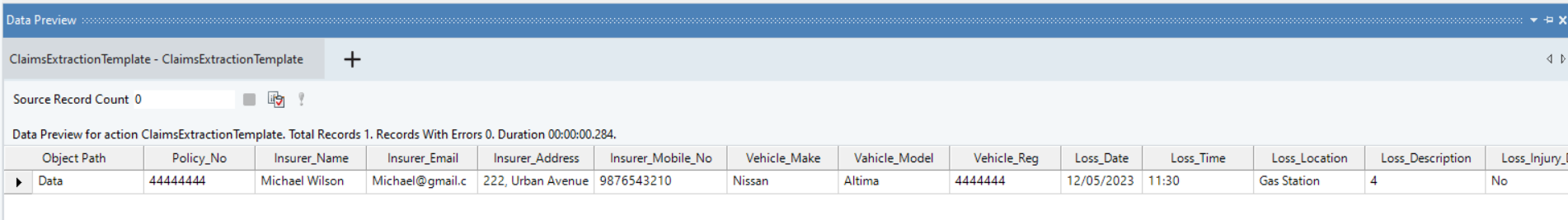

Step 4: After specifying the data fields and the region and their positions to capture in the report model, preview the extracted data output in the data preview window.

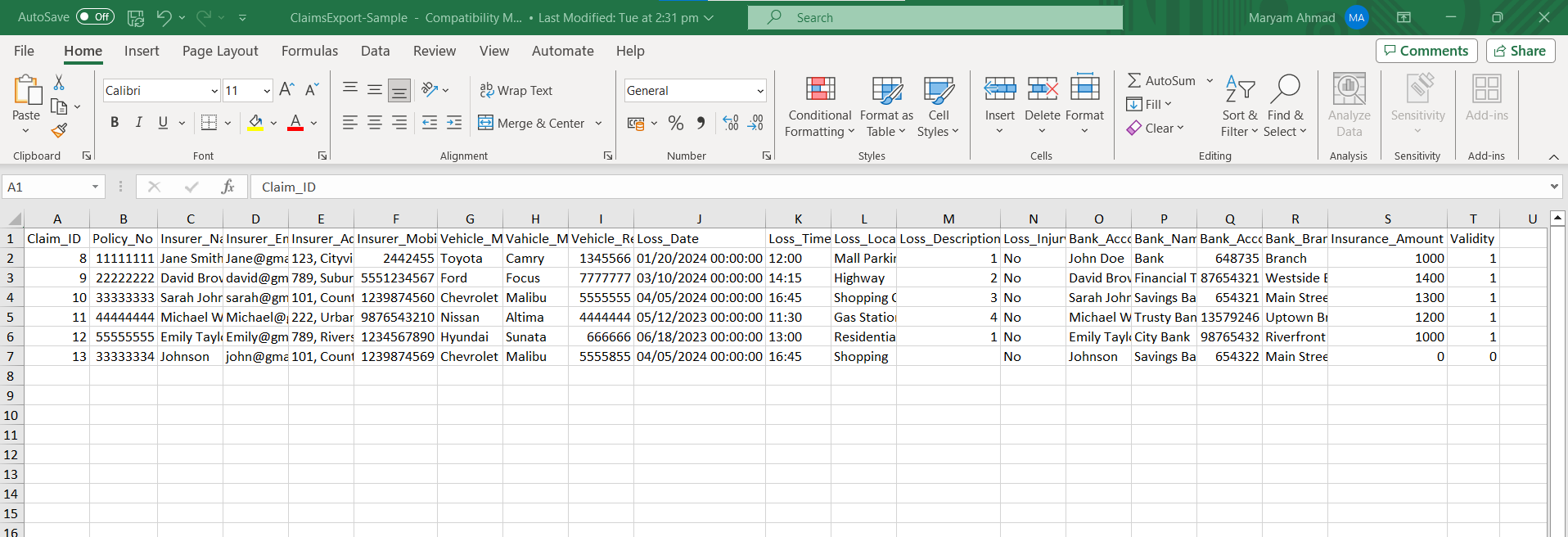

The claims information is now in structured format and can be stored in an excel sheet for further analysis.

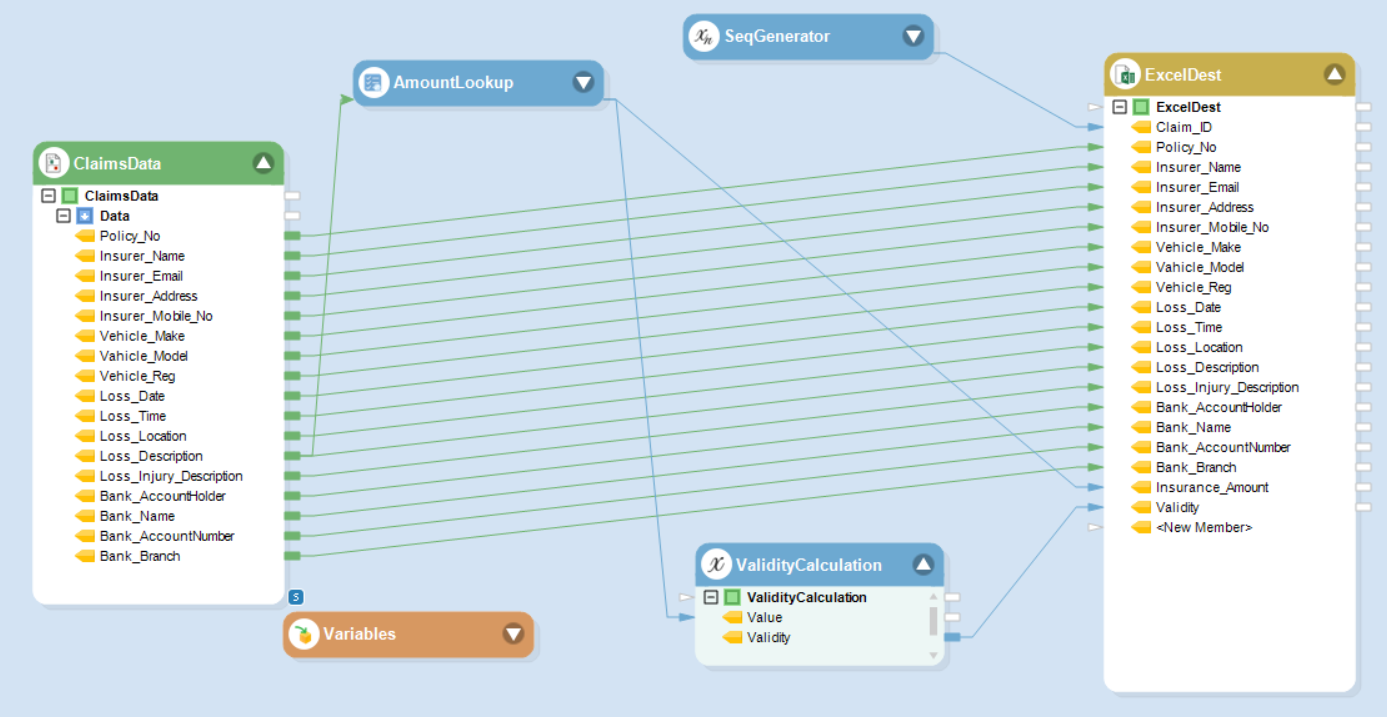

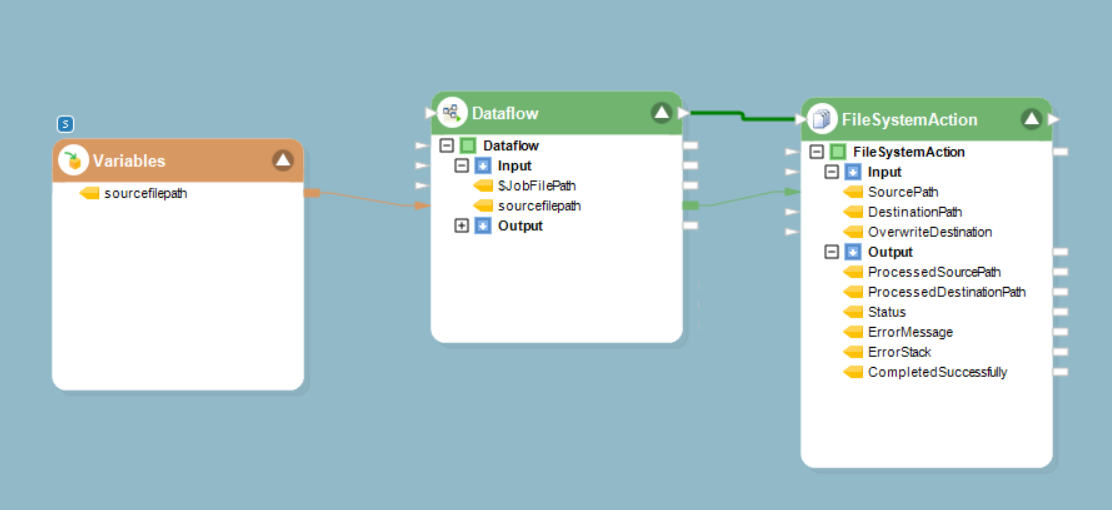

Step 5: To further automate the process of the structured claims data, add this report model to dataflow, where we can build data pipelines.

Step 6: The Lookup object is looking up the insurance amount in the database against the Loss Category value in the extracted claim data. We are including this amount in a new field in the claims record

Also check if a claim is valid. For instance, in this case if a loss isn’t in the listed categories, the claim is marked invalid, and the system won’t assign any amount to it. In such cases, instruct the system to record an error.

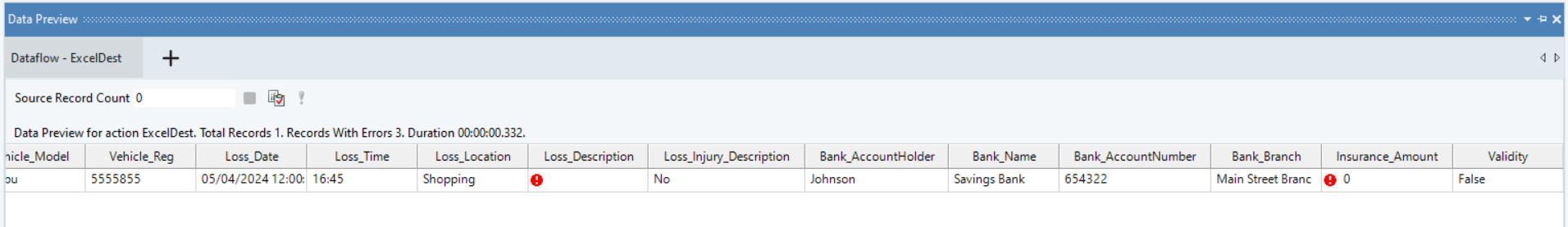

Step 7: Once the Dataflow runs, we can see the process detects an error in one of the claims, resulting in the non-assignment of insurance amount and marking the validity as 0.

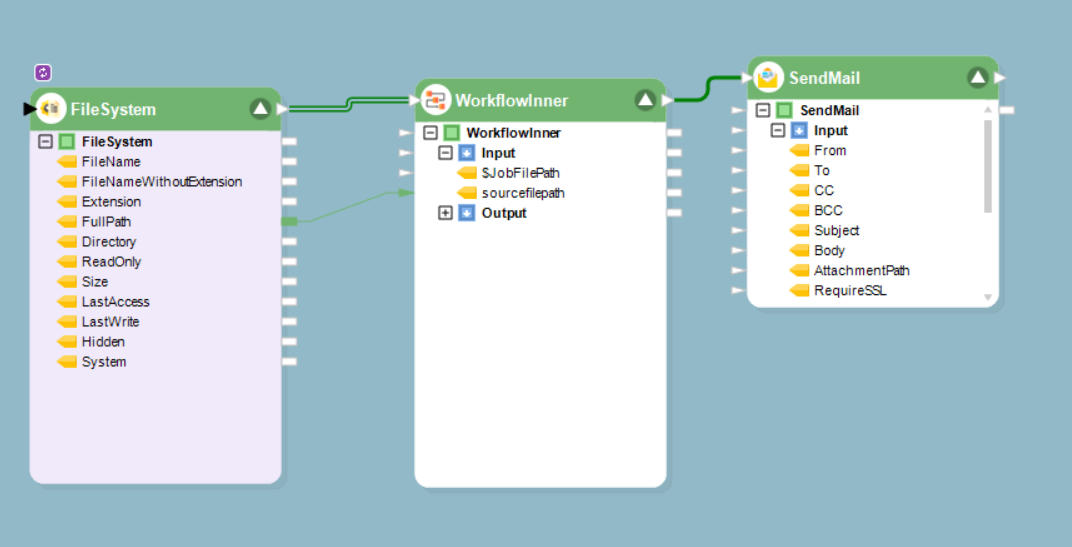

Step 8: Currently, this data processing is for a single file. To handle an entire batch, utilize the FileSystem to fetch every file in the folder and process each file through the data pipeline we designed.

Step 9: Astera ReportMiner also offers automated monitoring. By employing the SendMail tool, we can configure the system to automatically send an email once all files have been processed.

Once we run the workflow, the insurer has all the relevant information for each claim, simplifying the decision-making process and making it easier to determine which claims to proceed with.

Empowering Growth & Satisfaction for Insurers

Improving Customer Satisfaction

When a customer files a claim, Astera ReportMiner quickly sifts through the submitted documents. The software uses its data extraction tool to identify and pull relevant information in real-time.

This accelerates the initial review process and ensures that all data used in the decision-making is accurate and comprehensive. As a result, customers receive updates and resolutions at an unprecedented pace.

Astera ReportMiner integrates with customer service platforms, like Salesforce, enabling insurers to provide claim status updates directly to customers, fostering a transparent and trust-filled relationship.

Supporting Scalability and Growth

Astera ReportMiner scales success by providing a framework that easily handles increasing volumes of claims. Its template-based extraction model allows for the rapid processing of similar documents without the need for constant reconfiguration. This means that as an insurance company grows and the number of claims rises, Astera ReportMiner’s efficient data handling keeps the workflow smooth and uninterrupted.

Because the automation reduces the manual workload, users can allocate resources more effectively and focus on strategic growth initiatives.

Astera ReportMiner can handle growing claim volumes without compromising quality or speed, thus supporting the company’s expansion goals while maintaining high customer satisfaction. Discover the benefits of integrating Astera into your workflow and see the impact on your operational efficiency and customer service.

To explore how Astera ReportMiner can revolutionize your claims processing, schedule a demo today.

Streamline Auto Claims Processing with Astera

Ready to Simplify Your Claims Process? Try Astera's Data Extraction for Free! Get started with a 14-Day Free Trial and see how easy and efficient your claims processing can be.

Start a Free Trial NEW RELEASE ALERT

NEW RELEASE ALERT

March 27th, 2025

March 27th, 2025