Automated Claims Processing: A Comprehensive Guide

Claims processing is a multi-faceted operation integral to the insurance, healthcare, and finance industries. It’s a comprehensive procedure that involves carefully examining a claim. Claim processing is not a single-step process; instead, it involves multiple stages, each serving as a critical control point to ensure the accuracy and fairness of the claim resolution.

Industries are increasingly adopting automated claims processing to boost efficiency and accuracy in this critical function. According to a Statista study, 25% of insurance companies are exploring the possibility of transitioning to automation for claims processing in the foreseeable future. This technology-driven approach uses advanced tools to automate the traditionally manual stages of claims processing. It offers a more streamlined, accurate, and time-efficient method of handling claims.

While it significantly reduces the potential for human error, it also retains the need for human oversight in complex decision-making scenarios. This automation marks a significant step forward in claims management, offering the potential for improved efficiency and customer satisfaction.

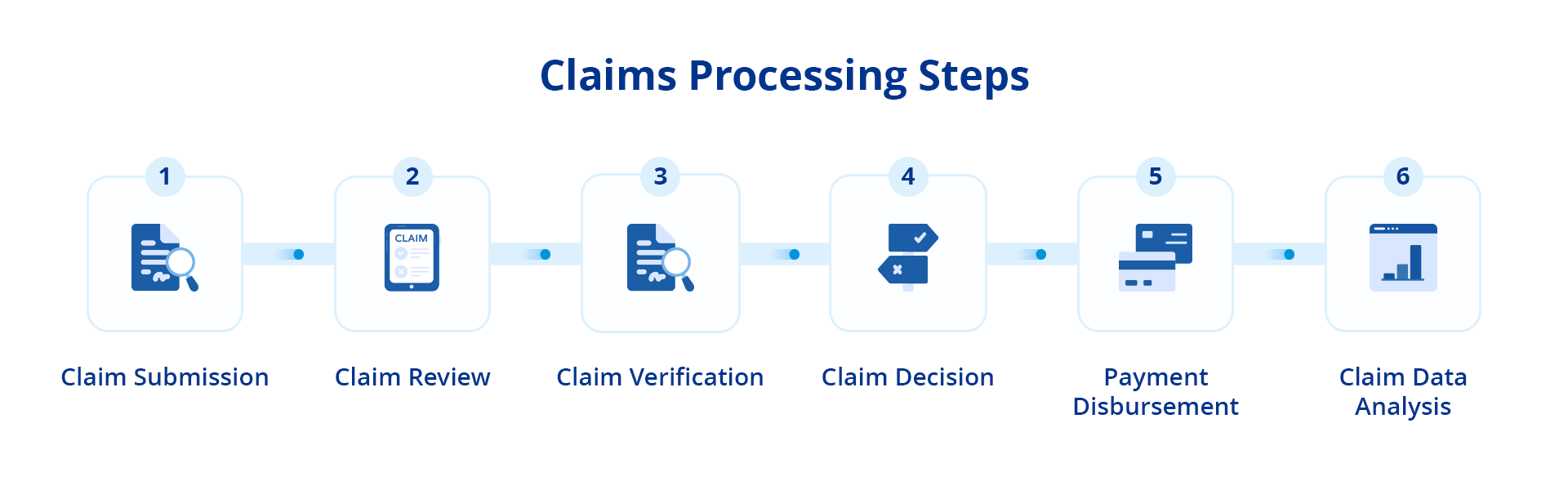

How Does Claims Processing Work?

- Claim Submission: The claims process is initiated when the policyholder files a First Notice of Loss (FNOL) to the insurance company. This step is the policyholder’s first communication with the insurer regarding a loss, providing initial details about the incident. Digital technology simplifies this step, allowing policyholders to submit their FNOL through digital platforms such as mobile apps or online portals, enhancing accessibility and efficiency.

- Claim Review: Upon receipt of the FNOL, the claim handler meticulously reviews the policy to determine the coverage. This stage thoroughly examines the policy terms and conditions and the claim’s specifics. The review process is significantly streamlined by automation, which detects crucial policy terms and cross-references the claimant’s details with external databases, ensuring a comprehensive and accurate review.

- Claim Verification: The insurer then proceeds to authenticate the claim by collecting additional data. This step may include damage assessments, incident photographs, witness statements, or relevant health documentation. The verification process is expedited by automation, which gathers data from various sources, enhancing the speed and precision of the process.

- Claim Decision: The next step involves the insurer evaluating whether to approve or deny the claim based on the policy terms and the verified claim details. Automation aids this stage by applying pre-set guidelines to establish the payout and coverage. However, a provision for human intervention is maintained for final checks to ensure fairness and accuracy, combining automation’s efficiency with humans’ nuanced decision-making ability.

- Payment Disbursement: Once the claim is approved, the insurer initiates the payment to the claimant. This step involves calculating the final settlement amount and arranging for its disbursement. The payment process is enhanced by automation, which uses digital payment methods, ensuring swift transactions and clear records, thereby enhancing transparency and traceability.

- Claim Data Analysis: After the completion of the claims process, the insurer can conduct an in-depth analysis of the claims data. Automation tools facilitate this analysis by providing structured data for easy examination and interpretation. The analysis offers valuable insights, enabling insurers to spot trends, detect potential fraudulent activities, and identify areas for process enhancement.

Manual vs Automated Claims Processing

Imagine a scenario where a policyholder is involved in a car accident. In a traditional manual claims processing system, the policyholder first must report the accident to the insurance company, often by phone or email. They would then need to fill out a detailed claim form and gather supporting documents such as photographs of the damage, a copy of the police report, and any medical reports if there were injuries.

Once these documents are submitted, a claims handler at the insurance company takes over. The handler manually reviews each document, extracting necessary information such as the date, time, and location of the accident, the extent of the damage, and the cost of any medical treatments. This extraction process is time-consuming and requires meticulous attention to detail to ensure no information is missed.

The claims adjuster then verifies the extracted information. They cross-reference the accident details with the police report, check the medical bills against the treatment details provided by the hospital, and compare the photos of the damage with the auto repair shop’s estimate. This manual verification process is tedious and prone to human error.

The Shift to Automation

Insurance companies increasingly seek ways to automate claims processing to mitigate these challenges. Automation speeds up the process and enhances accuracy and efficiency, reducing costs, minimizing errors, and improving customer satisfaction. According to McKinsey, automation can potentially reduce the expenses associated with a claims journey by up to 30%.

A key technology driving this transformation is Intelligent Document Processing (IDP). IDP combines the power of artificial intelligence and Optical Character Recognition (OCR) to extract data from unstructured documents, such as claims forms.

In claims processing, IDP can significantly speed up the process by automating tasks such as data extraction from claim forms and claim verification. For instance, OCR technology can scan and extract data from claim forms, regardless of their formats or sources. The artificial intelligence component of IDP ensures the accuracy of this process, enabling the system to learn from experience, identify patterns, make connections, and even understand the context of the extracted data.

By harnessing the power of IDP, insurance companies can deliver quicker and more accurate claim decisions, enhancing their service and improving customer satisfaction.

Here’s a comparison table to illustrate the differences:

| Manual Claims Processing | Automated Claims Processing | |

| Speed | Slower due to human intervention at each step | Faster due to automation at each step |

| Accuracy | Prone to human error | Higher accuracy due to automated checks |

| Efficiency | Less efficient due to manual handling | More efficient due to streamlined processes |

| Cost | Higher operational costs | Lower operational costs |

| Data Analysis | Limited and time-consuming | Structured data for easy and quick analysis |

| Transparency and Traceability | Limited | Enhanced due to digital records |

Who Benefits from Claims Processing Automation?

Automated extraction of unstructured data has reshaped the insurance industry, bringing about significant improvements in four key areas:

- Claims Processing:

Automation allows for swiftly extracting pertinent information from various data sources, making manual data entry redundant. Reducing errors and accelerating the claims process leads to substantial cost savings for insurance companies and expedites claim settlements for policyholders. Additionally, real-time tracking of claims, an automated feature, provides clients with unprecedented transparency.

- Claims Investigation:

Identifying patterns and anomalies in vast amounts of unstructured data has proven invaluable in claims investigation. Such proactive measures minimize losses due to fraudulent claims and ensure that policyholders’ premiums are not unjustly inflated to cover the cost of fraud. The integrity of the insurance system is maintained, protecting the interests of honest policyholders.

- Claims Management:

Automation revolutionizes the claims management process by easily compiling relevant information from various data sources. This efficient system improves resource allocation and decision-making for insurance companies. It keeps policyholders informed about the status of their claims, resulting in a more organized and efficient claims management process.

- Customer Service:

Extracting relevant information from unstructured data sources, such as emails and social media posts, enables insurance companies to respond to customer inquiries quickly and accurately. This process leads to higher customer satisfaction and enhances the overall customer experience. Furthermore, personalized communication with customers, another feature facilitated by automation, adds another layer to the customer service experience.

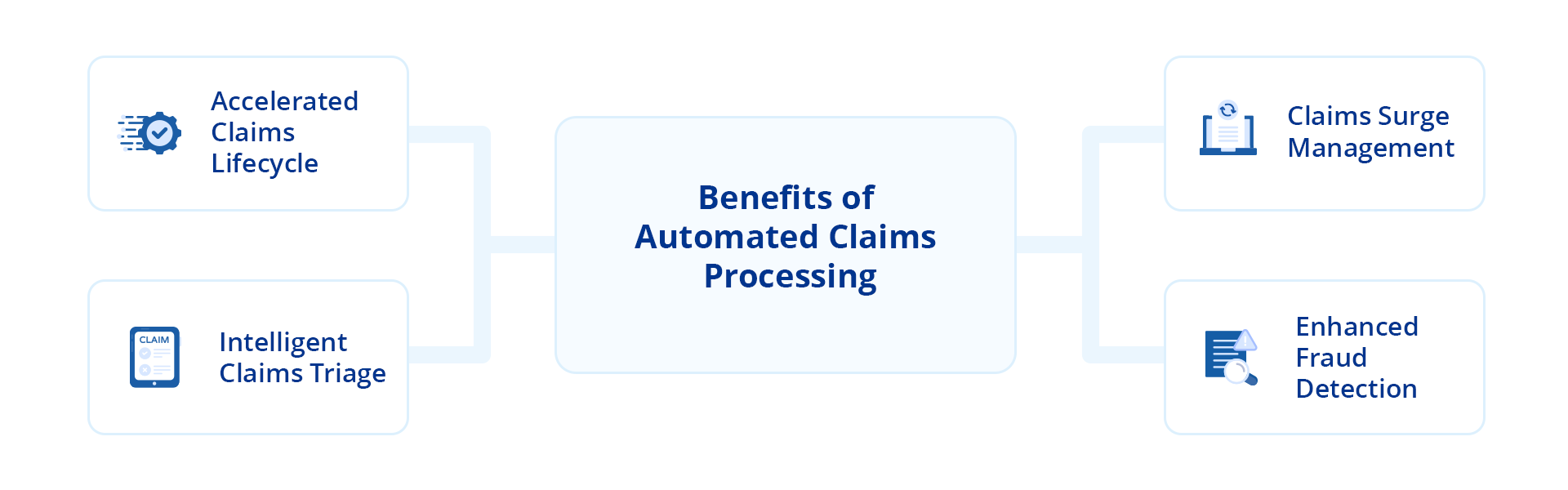

Benefits of Automated Claims Processing

Automated claims processing brings forth numerous benefits, enhancing efficiency, accuracy, and customer satisfaction in claims processing. Some notable benefits include:

- Accelerated Claims Lifecycle: Automated claims processing significantly reduces the time it takes from the initial submission of a claim to its final settlement. It swiftly extracts and processes relevant information from unstructured data, such as medical reports, accident scene photographs, or witness testimonies. This acceleration of the claims lifecycle improves operational efficiency and enhances the claimant’s experience by providing quicker resolutions.

- Intelligent Claims Triage: Automated systems can categorize claims based on their complexity or potential risk by analyzing unstructured data. Simple claims can be fast-tracked for immediate settlement, while complex or high-risk claims can be routed to experienced adjusters for detailed investigation. This intelligent triage optimizes resource allocation and ensures that each claim receives the appropriate level of attention.

- Claims Surge Management: In situations where there is a surge in claims volume, such as after a natural disaster or a large-scale accident, automated claims processing is invaluable. The system can handle large claims simultaneously, extracting data from various sources and processing claims swiftly. Therefore, insurance companies can efficiently assist customers and maintain consistent service levels.

- Enhanced Fraud Detection: Given that an estimated 5-10% of insurance claims are fraudulent, claims processing automation becomes critical. It helps claim adjusters detect patterns and anomalies in claims data that may signal fraudulent activity. They can also use this technology to cross-reference the claim data with historical data, policy terms, and industry benchmarks. Any discrepancies or unusual patterns are flagged for further investigation, enabling insurance companies to mitigate risks, reduce losses, and maintain the integrity of their operations.

Use Cases of Automated Claims Processing

While automated claims processing benefits insurers and policyholders, its impact extends beyond these advantages. This technology has been instrumental in streamlining operations across various industries, primarily:

Healthcare Insurance

The healthcare sector often grapples with the complexity and volume of insurance claims. In this context, automated claims processing is crucial. The automated system is designed to extract and process data from medical reports and hospital bills. It then cross-references each claim against the specific health insurance policy terms, verifying covered treatments, policy limits, and deductibles, ensuring that each aspect of the claim aligns with the policy provisions. Automation ensures accurate, fair, and timely claim settlements, significantly enhancing the efficiency of the healthcare insurance process.

Auto Insurance

The auto insurance industry, with its diverse range of claims from minor damages to total loss, requires a robust and efficient system for claims processing. Automated claims processing can efficiently manage data from accident reports and repair bills, determining whether the claim is valid and within the policy’s coverage. This step is crucial in maintaining the integrity of the insurance process and preventing fraudulent claims. Subsequently, the system calculates the settlement amount, reducing processing time, minimizing human errors, and improving customer trust in the auto insurance process.

Employment Insurance

Workers’ compensation claims, a significant component of employment insurance, can be complex due to the intricate nature of the data involved. Automated claims processing simplifies this process by extracting relevant data from injury reports, medical documents, and employment records. It verifies each claim against the workers’ compensation policy and calculates the compensation amount, expediting the claims process, ensuring accurate compensation, and improving employee satisfaction.

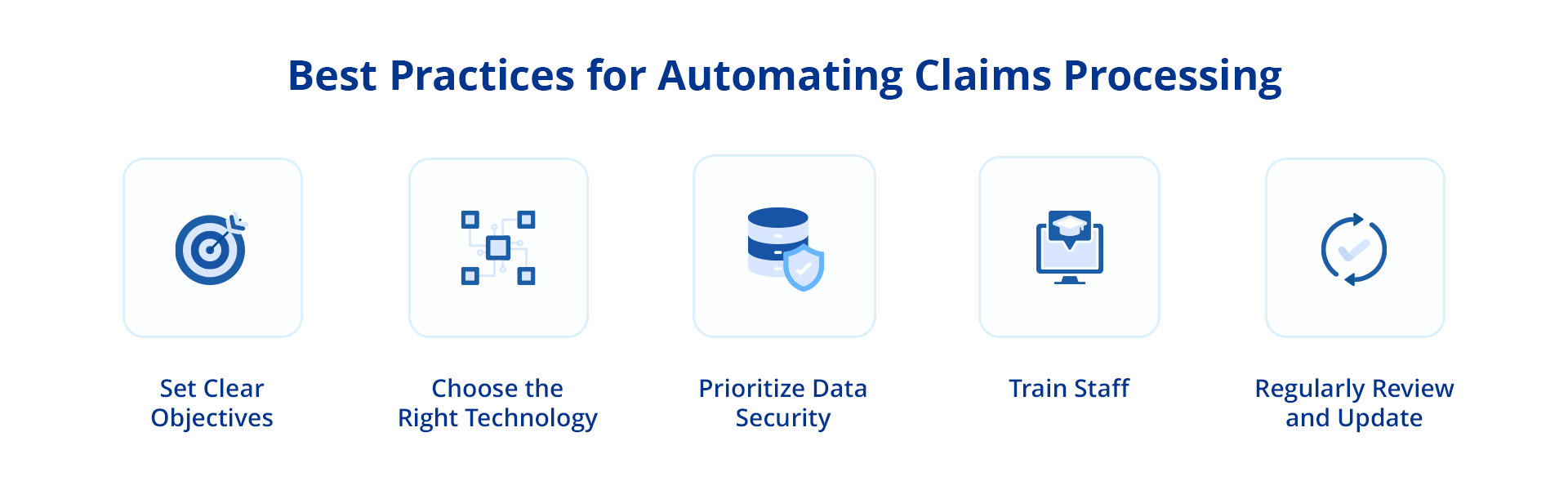

Best Practices for Automating Claims Processing

Transitioning to an automated claims processing system can significantly enhance an organization’s operational efficiency. However, to maximize the benefits of automation, it’s essential to adhere to certain best practices. These guidelines can help ensure a successful transition and optimal utilization of the automation system:

- Set Clear Objectives: Successful automation begins with clear and defined objectives. An organization should pinpoint the specific outcomes it aims to achieve with automation, such as reducing claim resolution time, enhancing accuracy, or elevating customer service levels.

- Choose the Right Technology: The selection of automation technology should be tailored to the organization’s specific needs, with the capacity to integrate with existing systems and handle the complexity of the claims process.

- Prioritize Data Security: Given the sensitive nature of data involved in claims processing, it’s essential for the chosen solution to adhere to data security standards and regulations, safeguarding customer information.

- Train Staff: Despite automation, the human element remains vital. Therefore, staff training on the new system is necessary to ensure effective usage and prompt issue resolution.

- Regularly Review and Update: As technology and business needs evolve, it’s essential for an organization to regularly review and update the automation system, ensuring it continues to meet changing needs and stays abreast of technological advancements.

The 3 Must-Haves of an Automated Claims Processing Solution

While implementing automation in claims processing, selecting a solution that meets specific needs and boosts operational efficiency is crucial. The ideal solution can significantly streamline the claims process. Here are three key features to consider during selection:

- System Interconnectivity: A solution should seamlessly integrate with important systems such as CRM, policy administration, and billing. This integration facilitates smooth data flow, eliminates data duplication, and boosts efficiency, leading to quicker and more accurate claim resolutions.

- Diverse Data Management: An automation system should be adept at handling a vast amount of unstructured and disparate data. A system with this capability enables faster and more precise data processing, crucial for extracting necessary information for claim resolution and accelerating the claims process.

- Unified Data Access: An automation system should centralize data from various sources into a single repository. A system with this feature promotes better collaboration, quicker decision-making, and constant system availability, all of which are key in streamlining the claims process and enhancing its efficiency.

Conclusion

Integrating automated claims processing with a focus on managing unstructured data marks a pivotal advancement in the insurance industry. This sophisticated approach streamlines cumbersome processes and enables insurers to extract valuable insights from previously untapped sources. Organizations can enhance efficiency, accuracy, and customer satisfaction by leveraging cutting-edge technologies like artificial intelligence and natural language processing.

However, successful implementation requires adopting a robust solution. This is where Astera steps in.

It offers a comprehensive suite of features to meet the unique demands of insurers. From seamless integration with existing systems to powerful data extraction capabilities, Astera equips insurance organizations with the necessary tools to thrive in today’s data-driven environment.

To learn more about Astera’s solution, download our 14-day free trial today!

Ready To Transform Your Claims Process?

Learn how Astera ReportMiner, an advanced unstructured data extraction solution with AI-powered data extraction capabilities, can streamline claims processing.

Download Free Trial Astera AI Agent Builder - First Look Coming Soon!

Astera AI Agent Builder - First Look Coming Soon!