Navigating Data Management Challenges in Mergers & Acquisitions: 9 Best Practices for a Smooth Transition

In the high-stakes world of business, mergers and acquisitions (M&A) represent a strategic move for companies to accelerate growth, diversify offerings, and enhance market presence. As reported by Bain & Company, the world of strategic M&A witnessed 27,000 deals announced, totaling approximately $2.4 trillion in the year 2023.

M&A deals, whether they involve acquiring a competitor, entering a new market, or merging with a complementary business, reshape industries.

As the number of M&A deals increases, so does the reliance on data to inform critical decisions. This is why organizations must effectively manage and leverage data to navigate these complexities and achieve their M&A objectives.

The Critical Role of Data in M&A

Mergers and acquisitions involve more than combining intellectual properties, customers, and services. Organizations are acquiring entire data ecosystems. While legal and financial aspects often dominate the early stages of integration, data management is a critical yet often overlooked component of post-merger success.

For organizations completing mergers or acquisitions, addressing data-related challenges must be a top priority. Effective data management can significantly enhance decision-making, streamline operations, improve customer experiences, and drive innovation. Ignoring data management risks can restrict these benefits.

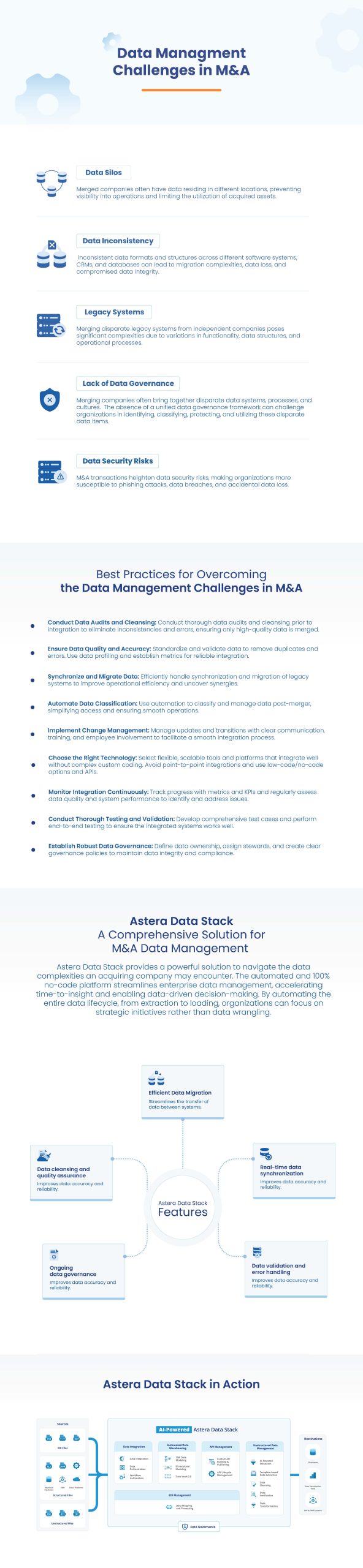

That said, let’s examine 5 critical data challenges organizations face during M&A.

Why Choose Astera for Accelerated M&A Integration?

Astera offers a unified platform designed to streamline all major data-related activities during M&A integration. Its intuitive %100 no-code interface allows companies to manage large volumes of data effortlessly, using simple drag-and-drop functions. This user-friendly approach ensures seamless data extraction, integration, transformation, and migration. Moreover, with Astera Data Pipeline Accelerator, companies only need to specify the source and destination of the data assets, and the platform takes care of the rest.

Astera’s zero-code platform supports end-to-end data management, helping organizations build a self-sustaining data ecosystem efficiently!

Get started with Astera to make your post-merger data integration easy. Schedule a demo or start your 14-day free trial today!

Astera AI Agent Builder - First Look Coming Soon!

Astera AI Agent Builder - First Look Coming Soon!