Data Warehousing for Insurance Reporting and Analytics

The significance of data warehousing for insurance cannot be overstated. It forms the bedrock of modern insurance operations, supporting data-driven insights and streamlined processes to better serve policyholders.

In recent years, data warehouses have become foundational tools for insurance companies, enabling them to efficiently manage, analyze, and leverage the immense volume of data for streamlined reporting and analytics. These centralized repositories play a crucial role in transforming raw data from disparate sources into actionable insights, empowering insurers to make informed, data-driven decisions.

The data warehouse has the highest adoption of data solutions, used by 54% of organizations. (Flexera 2021)

Data Warehousing for Insurance: Creating a Single Source of Truth

Insurance companies generate and receive large amounts of data from various business functions and subsidiaries that are stored in disparate systems and in a variety of formats. Centralizing and organizing data from disparate sources, such as customer information, policies, claims, and market trends, provides a unified platform for comprehensive analysis.

This analytical capacity enables insurance professionals to conduct intricate risk assessments, predictive modeling, and accurate trend analyses. That’s where a data warehouse comes in!

A data warehouse enables insurance companies to integrate this disparate data into a single source of truth, persist it in a report-oriented data structure, and create a centralized gateway to enable seamless reporting and analytics at the enterprise scale. The benefits of data warehousing for insurance companies are many, including:

- Centralized Data: A data warehouse allows the consolidation of data from diverse sources spread across different systems. This centralized repository ensures consistent, accurate, and up-to-date information is available for analysis.

- Efficient Reporting: Standardized data in a data warehouse simplifies the reporting process. The company can generate consistent and accurate reports for regulatory compliance, financial audits, and performance evaluation.

- Enhanced Analytics: A data warehouse enables advanced analytics, including predictive modeling, risk assessment, and customer behavior analysis. This enables the company to identify opportunities, optimize processes, and mitigate risks effectively.

- Cross-subsidiary Insights: With a data warehouse, the insurance company can gain insights that cut across subsidiaries. This can highlight cross-selling opportunities, identify areas of operational synergy, and improve customer experiences.

- Deeper Customer Awareness: Using a data warehouse, an insurance company can learn more about its customers. They can pinpoint customer preferences, behaviors, and requirements, thereby enabling precise marketing and customer service strategies.

- Improved Decision-Making: Access to a comprehensive dataset enables better decision-making. Executives can analyze trends, performance, and risk factors across the entire organization, leading to more informed strategic choices.

In addition, data warehousing helps improve other data management aspects, including:

- Data Integration: A data warehouse supports data integration across various subsidiaries, systems, and data formats, supporting interoperability and reducing data silos.

- Data Security: Centralizing data in a data warehouse enables the implementation of robust security measures, ensuring that sensitive information is appropriately protected.

- Data Quality and Consistency: A well-maintained data warehouse enforces data quality standards, ensuring that data is accurate, complete, and consistent.

Data Warehousing for Insurance: Who Can Benefit?

Data Team Leaders and Senior Personnel

As heads of the data team or senior members of an insurance organization, these individuals play a critical role in shaping data strategies. A data warehouse helps them access faster, more reliable insights. This helps them make better decisions, improve operations, and give the company a competitive advantage in the industry.

Data Analysts and Engineers

Data analysts and engineers often find themselves spending a substantial amount of time on mundane, repetitive tasks like data extraction, transformation, and loading (ETL) and data quality management. With a data warehouse in place, they can focus on higher-value activities such as identifying trends, improving risk models, and enhancing customer insights for better decision-making.

Business Users

Business users in the insurance industry face challenges related to data dependency, often experiencing delays in obtaining critical information. They rely on timely insights to make informed decisions and solve problems swiftly. A data warehouse addresses this by providing self-service reporting and analytics capabilities. Business users can generate reports instantly, reducing their dependence on IT or data teams.

Fraud Detection & Prevention Using Data Warehouse

A data warehouse can help insurance companies improve fraud detection process. A consolidated data repository enables them to employ anomaly detection and process integrity checks. Through continuous analysis of policyholder data and transaction records, the system establishes behavioral baselines, promptly flagging deviations for potential fraud. This centralized approach enables correlations across diverse data sources, unveiling hidden patterns indicative of fraudulent activities.

A data warehouse’s capability to consolidate information empowers insurers to minimize financial losses caused by fraud. Monitoring various operational aspects allows insurers to gain a comprehensive overview, supporting rapid identification of irregularities and potential fraud indicators. Real-time transaction monitoring helps in preventing fraudulent payouts, while predictive models, built on historical patterns, enable them to take proactive risk mitigation measures.

Data Warehousing for Insurance: A Smart, Long-term Financial Decision

An enterprise-grade data warehouse with end-to-end automation offers a great return on investment (ROI) to insurance companies by improving operational efficiency, introducing cost-saving opportunities, and enabling faster business intelligence. The ROI depends on the business goals and size of each organization, but in most cases, companies recover their cost of investment within the first three years.

Data warehousing for insurance require a considerable allocation of organizational resources, which sparks significant interest in both their initial justification and ongoing evaluation. It’s essential to acknowledge that despite this commitment, data warehouses frequently demonstrate themselves to be exceptionally valuable and rewarding investments.

Data Warehousing for Insurance: Try Astera!

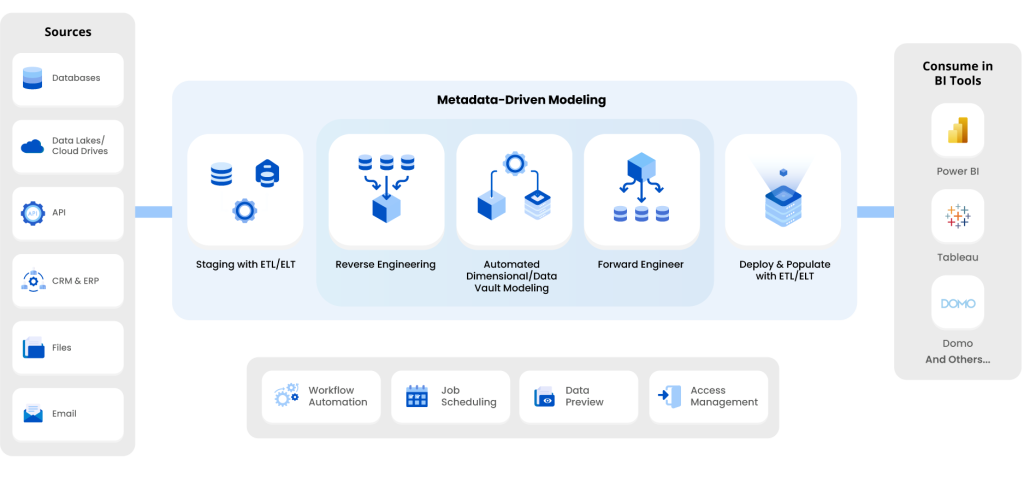

Astera offers a flexible and scalable data warehouse automation tool that allows you to design, develop, and deploy high-volume data warehouses for your insurance firm in days.

Built upon Astera’s industrial-strength ETL engine and refined by years of use by Fortune 1000 companies, our no-code solution allows insurance firms to lead with speed through its robust automation capabilities.

Astera’s data warehousing solution accelerates design, development, and implementation phases by automating low-level, repetitive tasks. This allows insurers to refocus resources on optimizing data processes and generating winning results.

Go from Source to Insights at Unprecedented Speeds

Combining the power of advanced data modeling features and parallel processing ETL/ELT engine with enhanced automation capabilities, Astera streamlines data warehousing for insurance firms, allowing them to speed up time-to-information and reduce dependency on IT, ensuring that analysts and underwriters have the right data at the right time for informed decision-making.

An All-Round Platform for Data Warehouse Development

Astera offers a comprehensive set of data warehousing features tailored to insurance companies’ data management requirements. It simplifies the process of bringing together data from on-premises and cloud sources, ensuring a unified and high-quality data foundation for improved reporting and analytics.

Insurance companies can also benefit from Astera’s capabilities to manage historical data effortlessly and connect to a wide array of sources and destinations. Smart features like push-down optimization can speed up data queries, making it easier for teams to get the insights they need. This means data analysts and actuaries can spend less time on technical tasks and more time focusing on things that drive value, like assessing risk, improving underwriting models, and spotting emerging trends in the market.

With quicker access to accurate data, insurance companies can better adjust their strategies and make decisions that keep them competitive in a fast-moving industry.

Astera also caters to the needs of insurance companies by providing instant access to data through self-service reporting and analytics dashboards. This reduces dependency and empowers them to make agile, data-driven decisions. With the ability to scale via cloud deployment, Astera ensures seamless growth and scalability as insurance organizations expand.

Additionally, Astera’s data lineage capabilities offer transparency and confidence in data management processes, while secure data movement from on-premises to the cloud ensures data security and compliance.

In summary, Astera equips insurance professionals with the tools they need to harness the full potential of their data for informed decision-making and competitive advantage.

Astera Advantage

Astera’s enterprise-grade data warehousing solution eliminates the need for extensive coding and complex infrastructure, reducing upfront and ongoing costs associated with traditional data warehousing development projects. Insurance firms no longer require a large team of data architects and modelers to manage your data warehouse.

With intuitive, drag-and-drop environment and advanced data modeling and ETL/ELT capabilities, designing and maintaining a sustainable data warehouse requires fewer man hours with Astera. Data warehousing projects that would typically take several months can be completed within a few weeks or even days.

With over 40 pre-built transformations, the Astera ETL solution offers increased uptime and greater reliability as compared to custom-coded solutions, which rely on certified data architects and engineers for maintenance.

Additionally, Astera’s unified solution saves costs by eliminating the need for separate licenses, maintenance, and support for multiple tools and vendors. As a result, data warehousing with Astera offers a substantially lower total cost of ownership (TCO).

By partnering with Astera, you can build a data warehouse that would serve your current and future reporting and analytics needs. To get started, reach us at sales@astera.com or request a free trial today.

Astera AI Agent Builder - First Look Coming Soon!

Astera AI Agent Builder - First Look Coming Soon!