Finance Data Warehouse for Reporting and Analytics

The role of data warehousing in finance is indispensable. It serves as the foundation of modern finance operations and enables data-driven analysis and efficient processes to enhance customer service and investment strategies.

Data warehouses have risen to prominence as fundamental tools that empower financial institutions to capitalize on the vast volumes of data for streamlined reporting and business intelligence. Banks, credit unions, insurance companies, investment companies, and various types of modern financial institutions rely on a finance data warehouse to make informed business decisions.

A centralized repository of accurate, complete, and timely data allows financial institutions to gather actionable insights to make informed choices across strategic, tactical, and operational fronts.

The North American data warehousing market is projected to dominate the global industry with a share of above 40% by 2025 (SDC Exec)

Strategic Insights: The Finance Data Warehouse Advantage

Financial institutions deal with a lot of data from various departments and subsidiaries. This data about customers, financial products, transactions, and market trends often comes in different formats and is stored in separate systems. To understand the vast amount of information available, they organize it and store it in a centralized repository. This consolidated repository helps analysts assess risks, predict future trends, and create effective strategies.

And this is where a data warehouse becomes important.

A data warehouse is the heart of this operation. It takes all the different data sources and puts them into one place, which makes it easier to report on and analyze. The key benefits of a finance data warehouse include:

- Centralized Data: A data warehouse contains data from various sources across different locations and systems. This consolidated repository ensures that financial institutions have a reliable, up-to-date, and accurate data pool for business intelligence.

- Efficient Reporting: Standardized data within a data warehouse simplifies the reporting process. This enables analysts to generate consistent reports swiftly, which are essential to evaluate performance, monitor financial health, and make informed strategic decisions.

- Enhanced Analytics: A financial data warehouse allows financial service providers to delve into advanced analytics to unlock a host of valuable benefits. These include improved loan portfolio management, more accurate credit risk assessment, and better fraud detection.

- Regulatory Compliance: Data warehouses help financial institutions to comply with the regulatory requirements by centralizing and organizing data in a way that facilitates audits, regulatory reporting, and compliance monitoring.

- Customer Insights: Integrating data from various customer touchpoints to a data warehouse allows financial institutions to gain a 360-degree view of customers’ payment behavior, transaction history, and overall financial health.

- Faster Decision-Making: Quick access to comprehensive and reliable data in a data warehouse streamlines decision-making processes, which enables financial organizations to respond rapidly to market changes and customer needs.

In addition, a finance data warehouse enhances various aspects of data management, such as:

- Data Integration: A data warehouse enables seamless integration of data from various systems and eliminates data silos and promotes interoperability and overall performance.

- Data Security: Consolidating data in a data warehouse supports the implementation of robust security measures to protect sensitive financial information, including personally identifiable information.

- Data Quality and Consistency: Data warehouses allow financial institutes to enforce rigorous data quality standards, which leads to improved data accuracy, completeness, and consistency.

Who Can Benefit from a Finance Data Warehouse?

Finance Executives and Decision-Makers

Senior leaders in financial organizations, including banks and credit unions, rely on data to drive strategic decisions. The centralized data repository allows for faster querying and, as a result, BI reporting. This leads to faster, more informed data-driven decision-making, which provides a competitive advantage in the financial sector.

Data Analysts and Technologists

Data analysts and technology professionals within financial institutions benefit from data warehousing by automating repetitive tasks like data extraction and transformation. This automation allows them to focus on higher-value activities such as data analysis and planning. It enhances their job satisfaction and enables them to contribute to the development of innovative financial products and solutions that drive business growth.

Business Users and Operations Teams

Business users within financial organizations often encounter challenges related to data accessibility and timely insights. With a data warehouse, they gain self-service reporting and analytics capabilities. This empowers them to generate reports on demand and reduce their reliance on IT or data teams. Such agility accelerates their ability to respond swiftly to market fluctuations, customer demands, and emerging financial opportunities.

Read More: The Cost of Building a Data Warehouse

How a Finance Data Warehouse can Help with Risk Management

The biggest functional area benefit of a Data Warehouse (DW) in finance is typically related to risk management. Data Warehousing enables financial organizations to aggregate and analyze vast amounts of historical and real-time data from various sources, which helps them assess and effectively manage various risks, including credit risk, market risk, operational risk, and compliance risk.

The ability to centralize and standardize data within a finance data warehouse allows for more accurate risk modeling, early risk detection, and improved decision-making. Additionally, it enhances the organization’s ability to meet regulatory requirements, which is crucial in the highly regulated financial industry.

A data warehouse architecture facilitates comprehensive insights into risk factors, which allows financial institutions to proactively identify potential issues, make informed risk assessments, and take the necessary actions to minimize financial losses and protect their stability and reputation.

Building Credit Scoring Models with a Finance Data Warehouse

Comprehensive customer data can be used to develop advanced credit scoring models. These models take into account a wide range of factors, including income, employment history, debt-to-income ratio, and behavioral data. Financial institutions can then use these scores to make decisions about interest rates, credit limits, and loan approvals.

This scoring model also enables them to tailor credit terms to each borrower’s risk profile. For example, customers with a strong credit history and stable income may be offered lower interest rates and higher credit limits, while those with higher risk profiles may receive more stringent terms. This helps set appropriate terms for different customer segments, leading to more informed and suitable lending decisions.

Finance Data Warehouse: A Strategic, Future-Proof Investment

An enterprise-grade data warehouse automation solution can give financial institutions significant returns. It streamlines data processes, reduces manual efforts, and enhances data accuracy, which ultimately leads to improved operational efficiency and cost savings. The return on investment varies based on a company’s size and objectives, but in the majority of cases, financial organizations typically recover their initial investment within the first two to three years, or even faster.

Building a finance data warehouse demands a substantial allocation of organizational resources, which raises concerns about both its initial justification and ongoing assessment. But despite this commitment, data warehouses consistently prove to be highly valuable and lucrative investments in the financial sector.

Building a Finance Data Warehouse? Try Astera DW Builder!

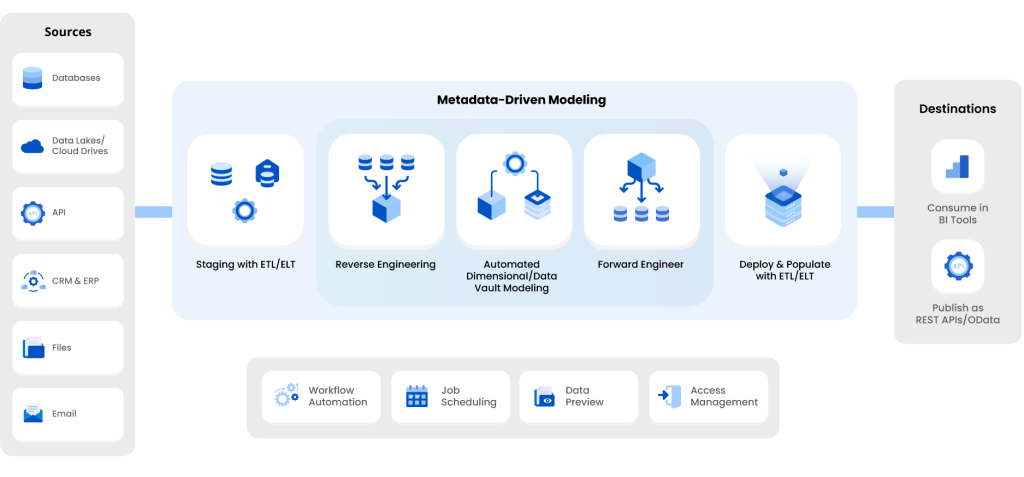

Astera offers a no-code data warehouse automation solution that empowers you to design, develop, and deploy high-volume finance data warehouses in a matter of weeks.

Trusted by Fortune 1000 companies, the flexible and scalable data warehousing solution comes with automation capabilities to fast-track design, development, and implementation phases. Equipped with Astera’s industrial-strength ETL engine, you can build metadata-driven data models from scratch or reverse engineer your existing data models—all in a unified, zero-code environment.

An All-Round Platform for Finance Data Warehouse

Astera’s data ecosystem has a powerful parallel processing ETL/ELT engine and data transformation, validation, and monitoring features. It also provides a tailored set of data warehouse automation features to meet your specific data requirements.

The no-code platform simplifies the resource-intensive task of consolidating data from various sources, including both on-premises and cloud platforms, to ensure you have a unified, high-quality data foundation that greatly enhances your financial reporting and analytics.

For financial organizations, Astera’s capabilities allow the efficient management of historical financial data, which makes it easier to connect to diverse data sources and destinations. Smart features like push-down optimization significantly improve query performance, which enables finance professionals to focus on value-added activities, such as financial analysis, to identify emerging opportunities, optimize financial operations, and align their strategies with changing market dynamics.

Astera also has a library of built-in connectors that allow financial institutes and financial service providers to ingest and load data to reporting and analytics dashboards. Agile connectivity minimizes manual interventions and improves data accessibility.

Coupled with Astera’s data lineage and scalability, these tool capabilities empower organizations in the finance industry to seamlessly handle data management processes as they grow while ensuring security and transparency throughout the process.

In a nutshell, Astera empowers financial professionals with the solution to make data more accessible for reporting and analytics, which results in more transparency, visibility, and informed decision-making.

Astera Advantage

Astera’s data warehousing automation tool simplifies and accelerates the development process. The metadata-driven, no-code solution allows financial organizations to design, develop, and deploy an enterprise-grade data warehouse without requiring complex infrastructure or coding. This means that data warehousing projects that would require months or even years to complete can be completed in a matter of a weeks.

- Advanced Data Modeling and ETL/ELT Capabilities: Astera enables users to build automated data pipelines, which streamlines data processing with minimal manual intervention.

- Pre-built Transformations and Connectors: Astera provides a library of pre-built transformations and connectors that optimize data warehouse connectivity, which allows financial institutions to handle vast amounts of data from various channels.

- User-Friendly Interface: Astera’s drag-and-drop, intuitive user interface makes it easy for both technical and non-technical users to manage and maintain data and adapt to evolving business requirements.

Astera’s unified solution also offers significant resource savings by eliminating the need for separate licenses, maintenance, and support for various tools and vendors. As a result, building a finance data warehouse with Astera provides a substantially lower total cost of ownership.

With Astera as your partner, you can build a finance data warehouse for your reporting and analytics needs. To get started, reach us at sales@astera.com or request a free trial today.

What does a financial data warehouse model typically include?

What are the applications of a data warehouse in the financial services industry?

What are the common challenges faced in designing a financial data warehouse?

Designing a financial data warehouse comes with various challenges, such as ensuring data accuracy, handling large volumes of data, and maintaining security. The top three technical challenges include:

- Data Integration: Merging data from multiple systems and sources without errors or inconsistencies.

- Data Quality: Maintaining high accuracy, consistency, and reliability across large and complex datasets.

- Data Security: Safeguarding sensitive financial information from unauthorized access and potential breaches.

Astera AI Agent Builder - First Look Coming Soon!

Astera AI Agent Builder - First Look Coming Soon!