Automated Financial Document Processing: Your Path to Becoming a Success Story

The financial document processing domain has undergone a 180-degree shift in the past decade. It was at the brink of the 1980s when software providers began releasing document management systems aimed at helping companies save time, money, and effort in regard to financial document processing.

What started as simple document management systems using Optical Character Recognition to digitize printed financial documents has evolved into advanced, AI-powered solutions.

Today, businesses have access to AI-backed automated financial document processing solutions that can cut down document management and processing time from days to a few minutes. This efficiency is crucial for overall business success.

This piece will shed light on how automated financial document processing benefits businesses. But first, let’s define what it is.

What is Automated Financial Document Processing?

Automated financial document processing refers to the use of technology like AI and ML to handle financial documents without the need for manual intervention.

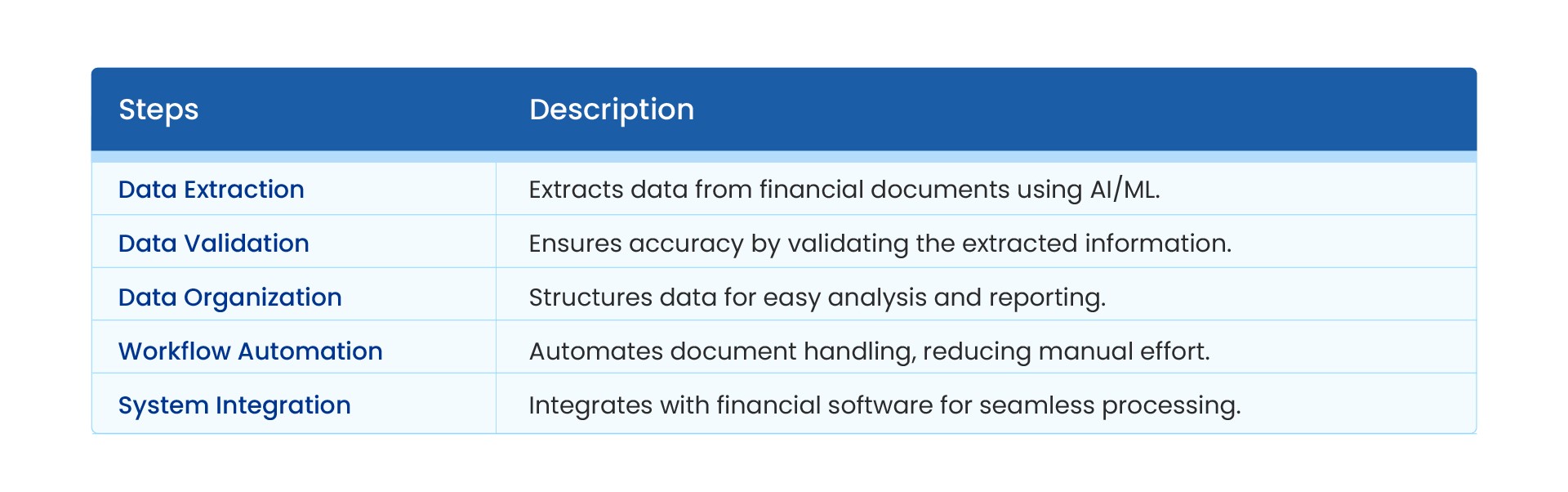

This process involves:

- Extracting data from different financial documents

- Validating the information

- Organizing it into structured formats for easy analysis, reporting, etc.

- Automating workflows to reduce manual effort and streamline document processing.

- Integrating with financial systems to enable smooth reporting and compliance.

5 Benefits of Automated Financial Document Processing

Let’s assume your financial document processing is functioning smoothly. So, why should you then consider shifting to an automated financial document processing system? Here are a few benefits to convince you:

- Less Time Spent on Manual Tasks: If you have ever conducted manual financial document processing, you must know the pain of handling piles on piles of paperwork. According to an Adobe Acrobat survey, around 48% of respondents struggled to find documents. Automated systems can help you eliminate these tasks from your to-do list, empowering you to automate tasks like data extraction.

- Cost Savings: Manual document processing can be costly due to the need for more staff and resources to handle the workload. Financial document processing automation allows you to reduce overhead costs related to labor.

- Ensures Compliance: Navigating financial regulations can feel like walking a tightrope. For example, a financial institution must comply with data protection and privacy regulations. Automated systems can act as your compliance partner. They help keep you out of trouble by ensuring your documents are processed in accordance with legal requirements.

- Improved Accuracy: Inaccurate data can cost companies around 15% of their revenue. When humans handle multiple financial documents, they are prone to mistakes. Automating processes minimizes the chances of human errors that can lead to inaccuracies.

- Simplifies Complex Processes: Financial document processing can be a real puzzle, with tasks like account reconciliation often becoming a manual headache. Automation solves the puzzle by efficiently integrating your existing systems and handling complex workflows.

Transform Your Financial Workflows with Astera

Astera’s AI document processing solution automates financial workflows for fast, accurate, and scalable document processing.

Schedule a DemoAutomated Financial Document Processing Use Cases

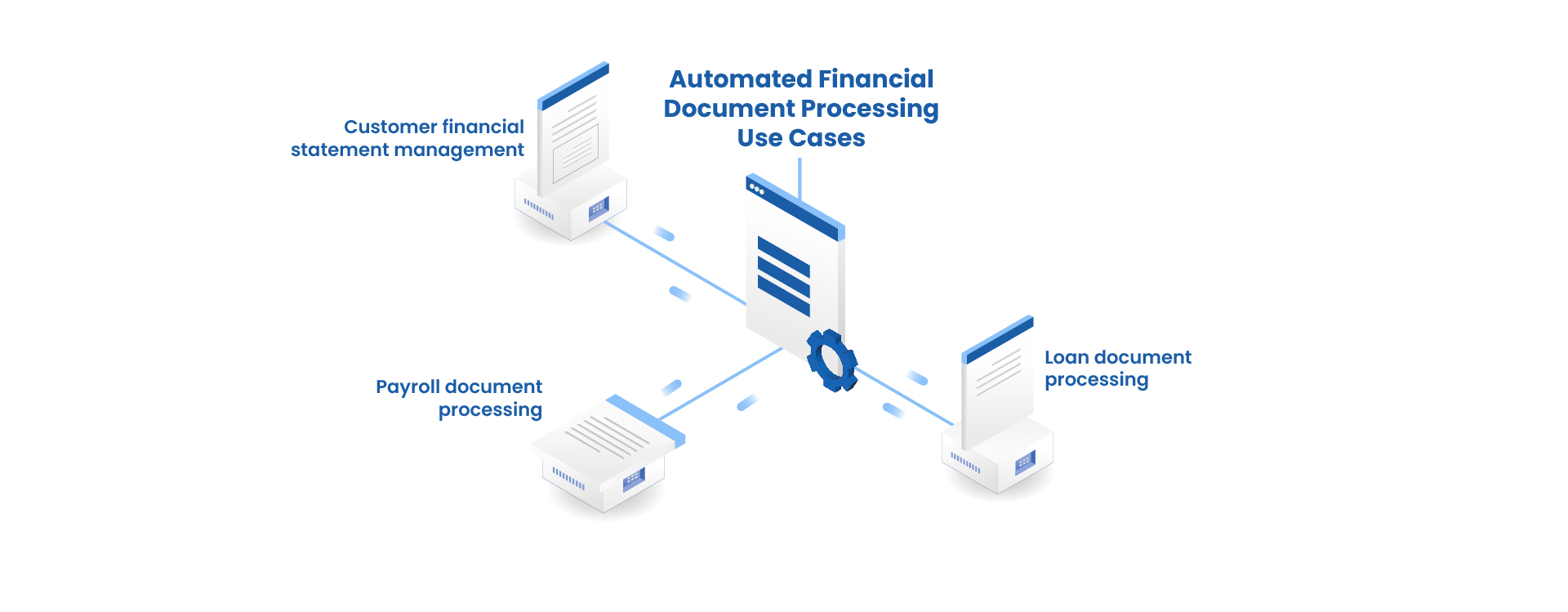

Here are a few areas where automated financial document processing can come in handy:

Customer Financial Statement Management

Managing customer financial statements can be tedious. Add manual handling to the mix, and it’s a recipe for a real headache. Automated financial documents help automate all processes involved, including extracting data like account balances, and smoothly entering them into relevant financial platforms.

Payroll Document Processing

When it comes to payroll compliance, accuracy is a no-brainer. You don’t want to accidentally send Sarah from HR her boss’s paycheck; she might think she just received the pay hike of a lifetime!

Automation takes care of this by processing all pay-related documents without the usual hassle. You set the rules, and the automated system calculates salaries, manages deductions, and applies tax withholdings.

Loan Document Handling

Automation keeps things moving smoothly in the loan management domain. The system does it all. It extracts important information like loan amounts, interest rates and repayment terms, and populates databases and personalizes loan offers with minimal effort from your end.

As businesses integrate automated systems to streamline their loan management, accurate data entry becomes essential for providing competitive interest rates for business funding. Automating the extraction and verification of relevant details such as loan amounts, tenor, and terms ensures that financial institutions can offer loans efficiently.

Besides this, it also keeps track of document statuses, sends timely notifications to stakeholders, and speeds up the loan approval process.

Questions to Ask When Choosing an Automated Financial Document Processing Solution

Ask yourself the following questions when choosing an automated financial document processing system to ensure an informed decision:

Is the Financial Document Automation Solution Scalable?

Picture your business doubling in size. Will your document processing solution keep pace or slow down? This is why scalability matters when it comes to selecting an automated financial document processing solution. A scalable system helps ensure you can process growing volumes of documents.

Does the Solution Include Compliance and Security Features?

Handling sensitive financial documents can come with a lot of pressure, especially in the wake of incidents like the Pandora Papers, which involved the global leak of over 12 million documents. An automated financial document processing system can relieve some of this pressure by ensuring compliance with industry regulations. It achieves this by:

- Offering consistent data validation

- Minimizing human errors

- Eliminating the need for manual processing

Is the Solution Customizable?

No two businesses are the same, and neither should their solution be. A customizable system adjusts to your workflows like a perfectly tailored tux. It can boost your document processing abilities by fitting smoothly into your processes.

Does the Solution have AI Capabilities?

Why settle for the ordinary when you can access AI-powered automated solutions? AI improves financial document processing by allowing you to pull information from documents with any layout or schema in seconds. It also enables smooth data transfer using a wide range of built-in connectors.

Does the Solution have Automation Features?

You’ve probably heard the phrase “time is money,” and it rings especially true in finance. Automation helps save both as it takes over repetitive manual tasks. This helps free up your resources and time and empowers them to focus on high-value work.

How Astera’s AI Document Processing Can Help You Achieve Financial Success?

Astera’s AI-powered automated document processing solution offers a transformative approach to automating your financial workflows. Here’s how it can help you achieve your financial goals:

- Lightning-fast and Reliable: Automate the extraction and processing of unstructured documents. Ensure timely invoice payments and accurate customer transactions.

- Smart AI Engine at Work: Quickly recognize metadata and fields like invoice numbers, dates, and amounts. Extract data from documents with any layout or schema in seconds.

- Seamless Integration: Easily integrate with existing ERP and accounting systems to boost overall operational efficiency.

- No Room for Human Errors: Improve accuracy in data extraction and processing with LLMs that generate an accuracy score to assess output quality.

- Speed Meets Efficiency: Automate the entire document processing workflow to reduce processing times and allow resources to focus on more strategic tasks.

- Scalability: Smoothly handle increasing volumes of documents without the need for added manual effort.

Businesses can simplify financial document processing and achieve greater success by using the Astera AI Document Processing solution. Contact us today to learn more about how we can support your journey toward financial success.

Astera AI Agent Builder - First Look Coming Soon!

Astera AI Agent Builder - First Look Coming Soon!