Managed File Transfer in Banking: A Complete Guide

In recent years, the financial services industry has witnessed a surge in cyber threat. In 2023, a staggering 64% of financial companies reported being attacked, signifying a steady increase. This surge is particularly concerning due to the increased volume of sensitive data. Including financial records, customer information, legal papers, and intellectual assets, being exchanged within the industry.

As information security has become an increasingly paramount concern as critical data, safeguarding sensitive data has become imperative. Managed File Transfer (MFT) emerges as an indispensable tool for the financial services industry. It’s designed to address the unique requirements of the banking sector and provide secure and efficient file transfers, ensuring the confidentiality, integrity, and availability of sensitive data.

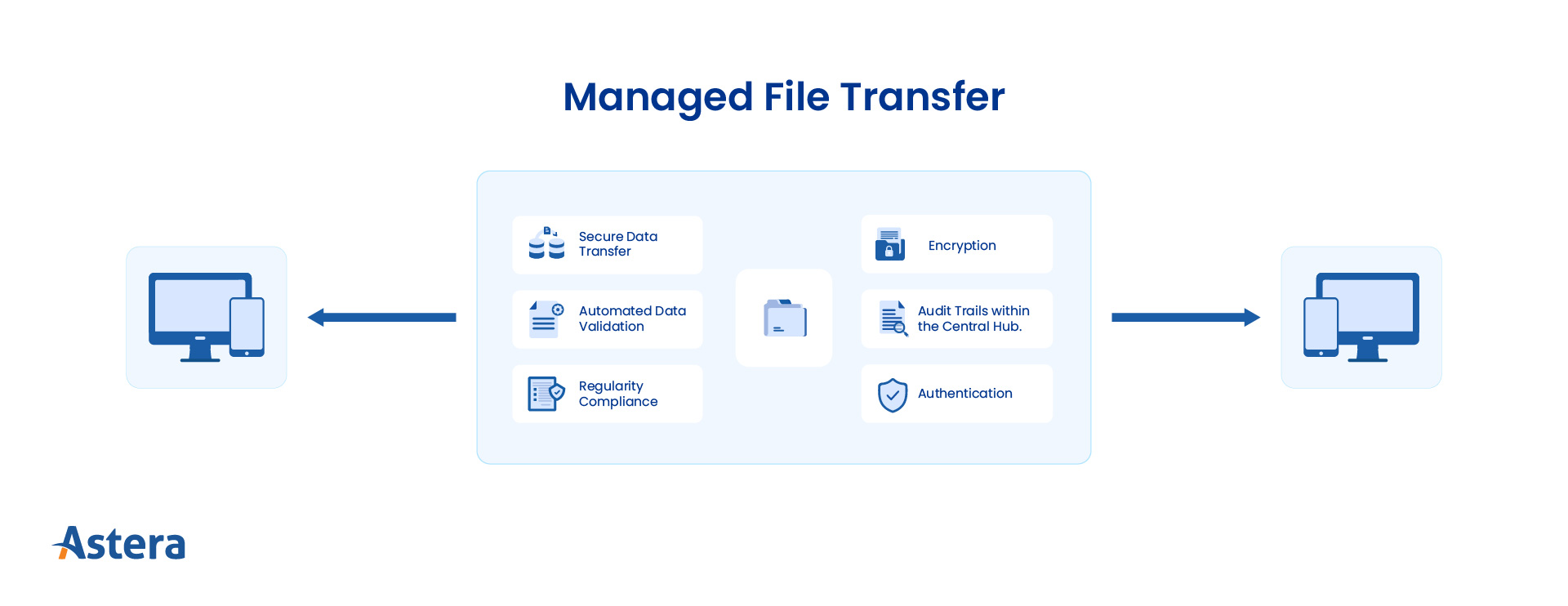

Understanding Managed File Transfer (MFT)

MFT is a comprehensive solution that enables secure and reliable file transfers between internal and external systems. It goes beyond traditional FTP (File Transfer Protocol) by providing additional security features such as encryption, authentication, and audit trails. Files can be transferred automatically or scheduled at specific times. Moreover, MFT supports various file transfer protocols such as FTPS (FTP over SSL/TLS), SFTP (SSH File Transfer Protocol), and HTTPS (Hypertext Transfer Protocol Secure).

In the banking industry, MFT serves as a central hub for managing file transfers, ensuring that sensitive data is exchanged securely and efficiently between banks, customers, and other stakeholders.

Importance of MFT in Banking

Given the sensitive nature of financial data, security is paramount for banks. MFT plays a vital role in ensuring sensitive files’ confidentiality, integrity, and availability. Here are some of the benefits of this feature:

Security Enhancement

Banks handle highly sensitive financial data, making security paramount. MFT shields against unauthorized access, potential data breaches, and regulatory compliance violations, playing a pivotal role in mitigating risks. Implementing MFT fortifies security measures, protecting customer information and upholding the bank’s reputation.

Operational Efficiency Boost

MFT significantly improves operational efficiency within banking systems. Manual file transfers are time-consuming and prone to errors. With MFT, file transfer processes can be automated, reducing human error and boosting productivity. This automation enables employees to focus on high-value tasks like financial analysis and personalized customer service, rather than routine file handling.

Regulatory Compliance Support

Comprehensive audit trails are essential in banking, particularly for regulatory compliance. Banks must maintain meticulous records of file transfers, including sender and recipient details, timestamps, and other transaction specifics and adhere strictly to banking industry regulations like PCI DSS, GLBA, GDPR, or regional standards. MFT automates this documentation, simplifying compliance efforts. Detailed logs and reports make it easier for banks to demonstrate adherence to regulations and swiftly respond to audit requests.

Data Protection & Encryption

With the escalating threat of cyberattacks, banks require robust solutions to protect information. MFT utilizes cutting-edge encryption protocols like SSL/TLS, ensuring secure transmission of data between banks and customers. This high-level security mitigates interception or manipulation risks, fostering trust and confidence for both banks and customers.

Seamless File Transfer Experience

Beyond security measures, MFT offers convenience and efficiency. Its standout feature lies in the ability to transfer files of any size. Banks can seamlessly exchange large financial statements, invoices, or loan applications without constraints. By eliminating file size limitations, MFT enhances communication between banks and customers, significantly improving the banking experience.

Automation & Scheduling Advantages

Automation and scheduling are pivotal aspects of MFT that benefit banks greatly. By removing manual intervention from file transfer processes, MFT streamlines workflows and optimizes resource allocation. Scheduled transfers reduce human intervention, minimizing errors, saving time, and enhancing operational efficiency, allowing banks to focus on strategic tasks.

Advanced Monitoring & Tracking

MFT provides advanced monitoring and tracking capabilities, offering real-time visibility into file transfer activities. This level of control enables proactive identification and resolution of issues, bolstering the security and reliability of file transfers. Enhanced oversight builds trust between banks and customers, reinforcing the relationship.

Challenges in Implementing MFT in Banks

While the benefits of Managed File Transfer (MFT) are evident, implementing it in a banking environment can present certain challenges that must be addressed.

Integration Issues

Banks often have complex IT infrastructures comprising various systems and applications. Integrating MFT with existing systems can be a complex task, requiring customized configurations and testing to ensure seamless operation. It is crucial to work closely with internal IT teams to address any compatibility issues and ensure smooth integration.

One of the integration challenges banks face is the need to connect MFT with their core banking systems. These systems handle critical functions such as account management, transaction processing, and customer relationship management. Ensuring that MFT seamlessly integrates with these systems is essential to maintain the security and integrity of financial data.

Another integration challenge is the compatibility of MFT with different file formats used in the banking industry. Banks deal with a wide range of file formats, including XML, CSV, and EDI. MFT solutions must handle these formats efficiently and ensure that data is transferred accurately and securely.

Training and Adoption

Introducing any new technology involves training end-users and promoting adoption. With MFT, it is essential to provide comprehensive training to employees on how to use the system effectively and securely. Banks should develop internal guidelines and best practices to ensure that MFT is used consistently across the organization.

Training programs should cover various aspects of MFT, including file transfer protocols, encryption methods, and user authentication. Employees need to understand the importance of following security protocols and best practices to prevent data breaches and unauthorized access to sensitive information.

Adoption of MFT may also require a cultural shift within the organization. Employees may be accustomed to using traditional file transfer methods, such as email attachments or FTP, which may not provide the same level of security and reliability as MFT. Banks should communicate the benefits of MFT to employees and encourage them to embrace the new technology.

Furthermore, banks should establish a feedback mechanism to gather insights from employees regarding their experience with MFT. This feedback can help identify any usability issues or areas for improvement, allowing the organization to enhance the MFT system and ensure its successful adoption continuously.

Compliance Made Easy: Secure File Transfers with Astera MFT

Automate workflows, simplify compliance, and safeguard sensitive data. Astera's MFT solution empowers secure file transfers for efficient banking operations.

Request a FREE DemoAstera Helps Financial Services Businesses with Secure File Transfer

Astera’s robust secure file transfer capability stands as a fundamental component within the Astera platform, offering organizations a secure solution designed to facilitate secure and efficient file transfers while seamlessly integrating with Astera’s broader data management ecosystem. Astera’s MFT system offers an automated end-to-end process, enabling swift extraction, transformation, and loading (ETL) of data immediately upon file receipt. This seamless workflow automation can be scheduled based on specific events such as emails or predetermined timeframes, ensuring an efficient and hands-free data processing experience.

Astera seamlessly integrates with various systems and applications, fostering interoperability across the organizational ecosystem. Its integration capabilities extend compatibility with CRM systems, ERP solutions, BI tools, and other software, facilitating a cohesive data exchange environment and empowering comprehensive business intelligence and decision-making processes.

Here are some key features of our file transfer solution:

- Diverse Protocol Support: Astera supports various transfer protocols like SFTP, FTP, email, cloud, HTTP, and AS2 for EDI, enabling connectivity with partners and systems through preferred methods.

- Secured File Transfers: Offering encryption/decryption with predefined algorithms or certificates and control over file size and type limits, Astera ensures heightened data security.

- Automated Workflows: Streamlining file transfer by automating repetitive tasks, Astera minimizes errors, saving time, and ensuring consistent, reliable transfers.

- Job Triggering and ETL: Enabling job triggering, including ETL and data extraction processes upon file receipt, ensures seamless data processing and integration with other systems.

- Advanced Scheduling and Notifications: Flexible scheduling options optimize transfers as per specific requirements, with real-time notifications keeping stakeholders informed of transfer statuses.

- Compliance Adherence: Astera assists in meeting industry regulations like GDPR and HIPAA, offering built-in features aligned with these standards for data privacy and compliance.

- File Monitoring and Tracking: Real-time monitoring of incoming and outgoing transfers provides transparency and control over data flow within the organization.

- File Journey Tracking: Senders can trace their files’ journey within the system, gaining visibility into transfer status and location.

- Role-based Access Management: Ensuring only authorized individuals access specific functionalities enhances security and compliance within the organization.

Conclusion

As the financial services industry continues its digital transformation journey, adopting MFT is crucial to stay ahead of regulatory requirements and secure customer trust. By leveraging the key features of MFT, such as secure file transfers, automation, and compliance reporting, banks can streamline their operations, enhance data security, and drive sustainable growth in today’s rapidly changing business landscape.

With multi-protocol support, robust security, automation, and compliance features, Astera seamlessly integrates with your data workflows. Take control of your data with Astera MFT. Ready to see it in action? Sign up for a demo or a 14-day- free trial now!

Astera AI Agent Builder - First Look Coming Soon!

Astera AI Agent Builder - First Look Coming Soon!